EPIC Provider Bulletin

Bulletin No. 05-01 - December 2005

This EPIC Provider Bulletin is also available in PDF format (PDF, 134KB, 8pg.)

Subject: Medicare Part D Drug Coverage

- Impact on EPIC Coverage

- Real-Time Coordination of Benefits

Medicare will begin providing prescription drug coverage on January 1, 2006, under Medicare Part D. The Medicare drug benefit will be offered by many different stand-alone drug plans and Medicare Advantage plans. This bulletin provides important information about how Medicare Part D will impact your EPIC customers and your pharmacy.

Highlights

Impact on EPIC Coverage

- EPIC enrollees are encouraged to consider joining Part D, and using EPIC to cover their out-of-pocket drug costs. Many enrollees can save more by using Medicare and EPIC together.

- As a reminder, Medicaid clients are not eligible for EPIC.

- When selecting a Part D plan, your EPIC customers should consider the plan pharmacy networks, formularies, premiums, drug quantities, and their current health coverage.

Real-time Coordination of Benefits

- All claims must first be sent to the Medicare drug plan. Medicare Part D is primary; EPIC is always payer of last resort.

- Please initiate any required prior authorizations to maximize Part D benefits; EPIC can be used in the interim when needed.

- EPIC and Part D plan dispensing limits do not always agree.

- New EPIC ID cards are being issued to enrollees with both EPIC and Part D coverage.

- EPIC is co-branding with Part D plans that agree to certain criteria designed to enhance coordination of benefits.

- EPIC cannot cover out-of-state (e.g. mail order) purchases.

- The EPIC/First Health Medicare Discount Card can still be used.

- EPIC applications can be requested by calling the EPIC Helpline or online (EPIC for Seniors at www.health.ny.gov)

Impact of Medicare Part D on EPIC Coverage

Medicare and EPIC can be used together

EPIC is encouraging all enrollees to consider joining a Medicare drug plan. Seniors can keep their EPIC coverage if they wish, and use it to "wrap around" the Medicare drug benefit for greater coverage and savings. The Medicare drug plan must be billed first and any remaining cost to the senior billed to EPIC as payer of last resort. This means any Medicare co-pays, deductible amounts, coverage gaps, and drugs not covered by the Medicare drug plan would be covered by EPIC (assuming the drug is an EPIC covered drug) less the EPIC co-pay and/or deductible.

EPIC enrollees are not required to join Part D. If they decide to join later, they will not pay higher Medicare premiums because EPIC is considered "creditable coverage", i.e. coverage determined to be, on average, at least as good as the standard Medicare drug coverage. (Medicare members that do not join Part D when first eligible are required to pay higher premiums, unless they have had other creditable coverage.)

Medicare offers additional savings to many EPIC enrollees

Many EPIC enrollees can save more by joining Medicare and using it with EPIC. However, the opportunity for savings depends on each senior's drug usage, income level, existing coverage, and location. The following categories provide general guidance on potential savings:

-

Low income seniors – Seniors with limited income and resources may be eligible for Extra Help paying for Medicare drug coverage. As shown in the chart below, if eligible for full Extra Help, these seniors will pay no Medicare drug premium, and will only pay $2 (generic) or $5 (brand) co-pays for drugs covered by their Medicare plan. There is no Medicare deductible or coverage gap for these seniors. And, EPIC will waive their enrollment fee, and cover drugs not covered by the Medicare plan for their usual EPIC co-payment. This is an excellent opportunity for EPIC enrollees who qualify. Please encourage them to complete the application for Extra Help available from Social Security (www.ssa.gov); you can refer them to EPIC or SSA for assistance.

Level of Extra Help Income Limits Assets Full: No Medicare premium (select plans), $2 generics/$5 brands, no coverage gap, EPIC fee waived $12,920

(couples $17,321)$7,500

(couples $12,000)Partial: Reduced Medicare premium, 15% co-insurance, no coverage gap $14,355

(couples $19,245)$11,500

(couples $23,000) - EPIC Fee Enrollees – Seniors in the upper Fee Plan not eligible for extra help may be attracted to one of the lower premium plan options in comparison to their EPIC fee, or possibly join both Part D and EPIC to achieve greater co-payment savings.

- EPIC Deductible Enrollees – Seniors in the Deductible Plan can achieve savings sooner by joining Part D, and maintain their EPIC coverage to provide free wrap-around protection. Their Medicare out-of-pocket drug costs will count toward their EPIC deductible. Therefore, they will never pay more, and in many cases less, than with EPIC alone. In fact, their EPIC deductible will reduce or even eliminate the Medicare coverage gap.

Reminder: Medicaid enrollees are not eligible for EPIC

As always, seniors receiving full Medicaid benefits are not eligible for EPIC. Those with both Medicare and Medicaid coverage (dual eligibles) will receive their prescription drug coverage from Medicare instead of Medicaid beginning January 1, 2006. These seniors will still not be able to join EPIC.

Medicaid clients who must meet a spend-down before receiving full Medicaid benefits can join EPIC; however, once they reach their spend-down and begin receiving full Medicaid benefits, they will automatically be enrolled by Medicare in a Part D plan for the remainder of the year and be dis-enrolled from EPIC.

Selecting a Medicare Part D plan

Many EPIC enrollees are looking for direction in selecting a plan. Under Medicare rules, EPIC is not able to select a preferred plan or plans for our EPIC enrollees. EPIC cannot steer enrollees toward any specific plans, and EPIC eligibility and financial assistance cannot differ based on the plan. EPIC enrollees can join the plan of their choice, and receive the same EPIC benefits regardless of the plan they choose.

The EPIC Participant Helpline (1-800-332-3742) is available to provide guidance and information to enrollees regarding EPIC and Medicare. EPIC is also working closely with the state Health Insurance Information Counseling and Assistance Program (HIICAP) and numerous community based organizations, all of which have been trained on EPIC and Part D and are available to assist EPIC enrollees in their community. Seniors can be referred to the local aging office in their county for HIICAP assistance; the EPIC Helpline can assist with these referrals if needed.

The following factors should be considered by your EPIC customers when selecting a plan, and may be useful to pharmacies when helping seniors:

- Other medical and/or prescription drug coverage

- Medicare Advantage (MA) members – Many EPIC enrollees are members of Medicare managed care plans. These enrollees can only select a drug plan offered by their MA plan, an "MA-PD". Their MA plan will be advising them of their choices, and may automatically be assigning them to an MA-PD if they currently have any drug coverage. Most of the MA-PD plans have low or no drug premium options which may be attractive to EPIC enrollees; however, caution must be exercised in advising these seniors on Part D enrollment, because their health coverage may be adversely affected.

- Employer/retiree coverage – Seniors with union or retiree coverage should check with their plan benefit administrator before joining Part D, to ensure they do not lose their union or employer benefits.

- Pharmacy network – Seniors need to make sure they join a plan they can use at their preferred pharmacy. We are advising seniors to check with their pharmacist to ensure the pharmacy is in the network of the plan of their choice. In order to coordinate benefits with Medicare Part D and EPIC, the pharmacy must participate in both the Medicare drug plan and EPIC.

- Formulary – To maximize savings, seniors should select a plan that covers all or most of their prescription drugs – ideally without prior authorization or other restrictions. We are advising seniors to gather a list of their current medications to compare to the formularies offered by the plans.

- Part D plan premiums – Seniors should enroll in a plan with a monthly premium they can afford and that will be cost beneficial. Those eligible for full Extra Help should select one of the plans approved for the full premium subsidy (list attached) so they pay no premium, otherwise they will have to pay the difference.

- Drug Quantities - Seniors should choose a plan that allows them to obtain at least the same quantities they currently receive at a pharmacy in their community. (Additional information is provided below.)

Real-Time Coordination of Benefits (COB)

This section explains how EPIC coverage will be coordinated with Medicare drug benefits in order to achieve the following goals --

- seamless real-time coordination of benefits

- uninterrupted access to needed drugs

- avoid cost shifting to EPIC

- maximize benefits for seniors

Claim sequence and processing

EPIC is always the payer of last resort. For EPIC enrollees, Medicare Part D is primary coverage. (There may be some EPIC members who also have other prescription coverage, which should also be billed before EPIC.) A monthly data exchange between EPIC and Medicare will inform EPIC which enrollees have Part D coverage and will also inform Medicare which beneficiaries have EPIC coverage.

The following claim sequence and processing should occur for EPIC enrollees with Medicare Part D coverage:

- Pharmacy submits online claim transaction to Part D plan.

- Part D plan response, whether payable or rejected, will include EPIC billing information (BIN/PCN) to ensure pharmacy is aware of secondary EPIC coverage.

- Pharmacy submits secondary online claim transaction to EPIC (using Part D specific BIN/PCN*).

- Claim must provide COB information (e.g. Medicare deductible or co-insurance, any denial reasons, etc. as detailed in payer specifications).

- EPIC response

- For claims covered by the Medicare plan (not necessarily paid by the plan, in the case of deductible and coverage gap claims), EPIC will cover the Medicare deductible and co-payments on behalf of the senior, less the EPIC co-payment (or deductible if not yet met) on that amount.

- EPIC will deny claims for enrollees with Part D when submitted to EPIC as primary, and identify the Part D Carrier and Carrier Code in the response.

- EPIC will provide the EPIC Bin/PCN that should provided when submitting claims for participants who have Part D coverage. This will be returned as a message and will not result in a claim rejection at this time.

- When EPIC is covering a Medicare co-payment, the EPIC co-payment will often be lower, resulting in added savings for the senior. For example, on a $100 drug covered by the Medicare drug plan for a $25 co-payment, the EPIC co-payment on $25 would be $7. Without the Medicare coverage, the EPIC co-payment would have been $20. Thus, the senior saves $13 by using Medicare and EPIC together.

- Claims not covered by the Medicare plan (e.g. non-formulary drugs, excludable drugs under Medicare, prior authorization denials) will be covered by EPIC if they are EPIC covered drugs.

Prior authorization

The Part D plans will often require prior authorization, sometimes for step therapy, as a means of managing costs and therapy. We are concerned with the potential disruption in access to needed medications that EPIC enrollees may encounter. We are also concerned that EPIC will often be used to pay for drugs that are the responsibility of the Part D plan, rather than requesting and waiting for a prior authorization from the plan. Therefore, when a claim is denied by the primary payer due to prior authorization or step therapy requirements, we are asking pharmacies to do the following:

Please contact the prescriber, or plan when applicable, to initiate a prior authorization (or arrange to dispense an alternative drug if appropriate).

- If PA approval or denial is obtained without delay, then a secondary claim should be sent to EPIC.

- When the PA is pending, the pharmacy can bill EPIC when necessary to avoid any potential problems for the senior. As always, a secondary claim should be sent to EPIC with the required COB data to reflect the initial denial by the Part D plan.

- If the pharmacy is notified that the PA was approved, the initial claim paid by EPIC should be reversed and billed to the Part D plan as primary and EPIC as secondary. The senior should be refunded the difference when a lower co-payment results.

- Because all claims need to be submitted to the Part D plan first, when refills are billed to the Part D plan, any PA approval should automatically apply and result in plan approval.

The cooperation of EPIC participating pharmacies in this practice is appreciated.

Dispensing limits

The Part D plans generally allow a 30-day supply and may also provide a 90-day supply option. As a result, quantities allowed by the plan will sometimes differ from those allowed under EPIC – which allows the greater of a 30-day supply or 100 tablets/capsules. The following explains how these differences will be addressed:

-

Plan limits higher than EPIC limits

Whenever EPIC is providing secondary coverage for a drug covered by the Part D plan, the plan dispensing limits under the primary coverage will apply. As a result, EPIC seniors will be able to obtain a larger supply. For example, for a prescribed dosage of two tablets a day, EPIC allows up to a 50-day supply of 100 tablets. The plan will allow a 90-day supply of 180 tablets.

-

Plan limits lower than EPIC limits

The 100 tablets/capsules that EPIC allows often equates to a 100-day or three-month supply when one tablet per day is prescribed. The 90-day supply, which is available from many of the Part D plans, will usually accommodate the same quantity. However, some plans limit the 90-day supply to certain pharmacies in their network or through mail order. We are advising seniors to check with the plans they are considering and their pharmacy to make sure they can receive the quantities they need. They also need to know that EPIC cannot be used at an out-of-state mail order pharmacy, even when providing secondary coverage. Some plans will allow a 90-day supply at their retail network pharmacies for three co-payments, which can be billed to EPIC as secondary for only one EPIC co-payment.

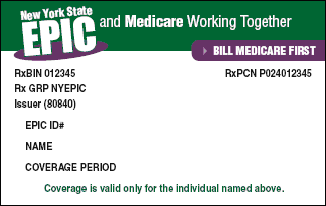

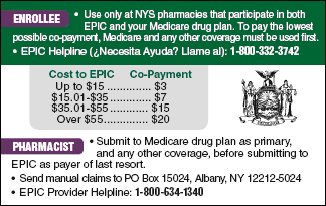

New EPIC and Medicare ID Cards *

EPIC is required to have a different Billing Information Number (BIN) and Processor Control Number (PCN) for enrollees with Medicare Part D coverage. The BIN/PCN combination is required for switching services to distinguish secondary drug claims to be routed to Part D plans for purposes of tracking true-out-of-pocket (TrOOP) costs under Part D. Once TrOOP costs reach the Medicare catastrophic threshold, the Part D benefits are significantly greater.

The EPIC BIN/PCN numbers are as follows (yes, the 012345 is correct):

| BIN | PCN | |

|---|---|---|

| EPIC only (existing card) | 009704 | P014009704 |

| EPIC and Medicare Part D | 012345 | P024012345 |

To accommodate the new BIN/PCN, EPIC is issuing new EPIC ID cards to seniors enrolled in Medicare Part D as shown below. These cards will be issued as soon as Medicare identifies which EPIC enrollees have joined a Part D plan, which is scheduled to begin by January 1, 2006 and monthly thereafter.

EPIC Co-Branded Plans

EPIC is encouraging all plans to satisfy certain criteria that were designed to enhance coordination with Medicare benefits at the pharmacy. In exchange, plans can highlight in their marketing materials that they are co-branding with EPIC. A sample of the co-branding criteria is included below:

- At least 80 percent of the top drugs used by EPIC enrollees must be on the plan formulary.

- At least 85 percent of the pharmacies used by EPIC enrollees must be in the plan network.

- The plan overall dispensing limits must be consistent with EPIC. A 90-day supply must be available to accommodate the larger EPIC quantities, even if multiple co-payments are required.

- Plan marketing materials that reference EPIC must receive prior EPIC approval, to ensure accurate information is provided.

The EPIC co-brand distinction must not be confused with an endorsement of Part D coverage for EPIC enrollees. It is not intended to steer seniors toward these plans, nor indicate better coverage than other plans.

Mail Order Pharmacies

EPIC coverage is available only at New York State pharmacies. Seniors will not be able to coordinate benefits with EPIC if they use out-of-state mail order pharmacies.

Medicare Drug Discount Card

EPIC seniors who have the First Health/EPIC Medicare drug discount card can continue to use their discount card until they enroll in a Medicare drug plan, but no later than May 15, 2006. For these seniors, pharmacies are required to bill the First Health card first, then EPIC as secondary.

EPIC Applications

Pharmacies are encouraged to maintain a supply of EPIC application/brochures at their pharmacy counter, and can request a supply at any time by calling the EPIC Provider Helpline at 1-800-634-1340. Applications can also be requested on the EPIC website at www.health.ny.gov, under EPIC for Seniors.