MRT Plan Current STCs - January 9, 2024

- Plan is also available in Portable Document Format (PDF)

CENTERS FOR MEDICARE & MEDICAID SERVICES

WAIVER AUTHORITIES

NUMBER: 11-W-00114/2

TITLE: Medicaid Redesign Team

AWARDEE: New York State Department of Health

All requirements of the Medicaid program expressed in law, regulation, and policy statement, not expressly waived in this list, shall apply to the demonstration.

The following waivers shall enable New York to implement the approved Special Terms and Conditions (STC) for the New York Medicaid Redesign Team (MRT) section 1115 demonstration (formerly the New York Partnership Plan) beginning April 1, 2022, and ending March 31, 2027.

1. Statewideness Section 1902(a)(1)

To permit New York to geographically phase in the Managed Long Term Care (MLTC) program and the Health and Recovery Plans (HARP) and to phase in Behavioral Health (BH) Home and Community Based Services (HCBS) into HIV Special Needs Plans (HIV SNP).

2. Comparability Section 1902(a)(10), section 1902(a)(17)

- To enable New York to apply a more liberal income standard for individuals who are deinstitutionalized and receive HCBS through the managed long-term care program than for other individuals receiving community-based long-term care.

- To the extent necessary to permit New York to waive cost sharing for non-drug benefit cost sharing imposed under the Medicaid state plan for beneficiaries enrolled in the Mainstream Medicaid Managed Care Plan (MMMC) - including HARP and HIV SNPs - and who are not otherwise exempt from cost sharing in 447.56(a)(1).

- Family of One Non-1915 Children, or "Fo1 Children" - To allow the state to target eligibility to, and impose a participation capacity limit on, medically needy children under age 21 who are otherwise described in 42 Code of Federal Regulations (CFR) § 435.308 of the regulations who: 1) receive Health Home Comprehensive Care Management under the state plan in replacement of the case management services such individuals formerly received through participation in New York's NY #.4125 1915(c) waiver and who no longer participate in such waiver due to the elimination of the case management services, but who continue to meet the targeting criteria, risk factors and clinical eligibility standard for such waiver; and 2) receive HCBS 1915(c) services who meet the risk factors, targeting criteria, and clinical eligibility standard for the above-identified 1915(c) waiver. Individuals who meet either targeting classification will have excluded from their financial eligibility determination the income and resources of third parties whose income and resources could otherwise be deemed available under 42 CFR §435.602(a)(2)(i). Such individuals will also have their income and resources compared to the medically needy income level (MNIL) and resource standard for a single individual, as described in New York's state Medicaid plan.

3. Amount, Duration & Scope Section 1902(a)(10)(B)

To enable New York to provide BH HCBS services and the Adult Rehabilitation Services named Community Oriented Recovery and Empowerment (CORE) Services, whether furnished as a state plan benefit or as a demonstration benefit to targeted populations that may not be consistent with the targeting authorized under the approved state plan, in amount, duration and scope that exceeds those available to eligible individuals not in those targeted populations.

4. Freedom of Choice Section 1902(a)(23)(A)

To the extent necessary to enable New York to require beneficiaries to enroll in managed care plans, including the MMMC, and MLTC (excluding individuals designated as "Long-Term Nursing Home Stays") and HARPs programs in order to obtain benefits offered by those plans. Beneficiaries shall retain freedom of choice of family planning providers.

5. Reasonable Promptness Section 1902(a)(8)

To enable the state to limit the number of medically needy Fo1 Children not otherwise enrolled in the Children's 1915(c) waiver.

Title XIX Requirements Not Applicable to Self-Direction Pilot Program

(see Expenditure Authority 8, "Self-Direction Pilot")

6. Direct Payment to Providers Section 1902(a)(32)

To the extent necessary to permit the state to make payments to beneficiaries enrolled in the Self Direction Pilot Program to the extent that such funds are used to obtain self-directed HCBS long term care (LTC) services and supports.

EXPENDITURE AUTHORITIES

NUMBER: 11-W-00114/2

TITLE: Medicaid Redesign Team

AWARDEE: New York State Department of Health

Under the authority of section 1115(a)(2) of the Social Security Act ("the Act"), expenditures made by New York for the items identified below, which are not otherwise included as expenditures under section 1903 of the Act shall, until the ending date specified for each authority as listed below, be regarded as expenditures under the state's title XIX plan. These expenditure authorities shall be effective from April 1, 2022, through March 31, 2027, except as otherwise noted.

The following expenditure authorities shall enable New York to implement the approved Special Terms and Conditions (STC) for the New York Medicaid Redesign Team Medicaid Section 1115 demonstration.

- Demonstration-Eligible Populations. Expenditures for healthcare related costs for the following populations that are not otherwise eligible under the Medicaid state plan.

- Demonstration Population 2 (Temporary Assistance for Needy Families (TANF) Adult). TANF Recipients. Expenditures for health care related costs for low-income adults enrolled in TANF. These individuals are exempt from receiving a Modified Adjusted Gross Income (MAGI) determination in accordance with 1902(e)(14)(D)(i)(I) of the Act.

- Demonstration Population 9 (HCBS Expansion). Individuals who are not otherwise eligible, are receiving HCBS, and who are determined to be medically needy based on New York's medically needy income level, after application of community spouse and spousal impoverishment eligibility and post-eligibility rules consistent with section 1924 of the Act.

- Demonstration Population 10 (Institution to Community). Expenditures for health care related costs for individuals moved from institutional nursing facility settings to community settings for long term services and supports who would not otherwise be eligible based on income, but whose income does not exceed the income standard described in STC 4.4(c), and who receive services through the managed long-term care program under the demonstration.

- Included in Demonstration Population 12 [Family of One (Fo1) Children]. Medically needy children Fo1 Demonstration children under age 21 with a waiver of 1902(a)(10)(C)(i)(III) who meet the targeting criteria, risk factors, and clinical eligibility standard for #NY.4125 waiver including intermediate care facilities (ICF), nursing facilities (NF), or Hospital Level of Care (LOC) who are not otherwise enrolled in the Children's 1915(c).

- Twelve-Month Continuous Eligibility Period. Expenditures for health care related costs for individuals who have been determined eligible under groups specified in Table 6 of STC 4.4(e) for continued benefits during any periods within a twelve-month eligibility period when these individuals would be found ineligible if subject to redetermination. This authority includes providing continuous coverage for the Adult Group determined financially eligible using MAGI based eligibility methods. For expenditures related to the Adult Group, specifically, the state shall make a downward adjustment of 2.6 percent in claimed expenditures for federal matching at the enhanced federal matching rate and will instead claim those expenditures at the regular matching rate.

- Facilitated Enrollment Services. Expenditures for enrollment assistance services provided by managed care organizations (MCO), the costs for which are included in the claimed MCO capitation rates.

- Demonstration Services for Behavioral Health Provided under Mainstream Medicaid Managed Care. Expenditures for provision of residential addiction services, crisis intervention and licensed behavioral health practitioner services to MMMC enrollees only and are not provided under the state plan [Demonstration Services 9].

- Targeted Behavioral Health HCBS and CORE Services. Expenditures for the provision of BH HCBS and CORE Services under HARP and HIV SNP that are not otherwise available under the approved state plan [Demonstration Services 8].

- Self-Direction Pilot. Expenditures to allow the state to make self-direction services available to HARP and HIV/SNP enrollees receiving BH HCBS or children meeting targeting criteria for the Children's 1915(c) Waiver and in MMMC receiving HCBS under the Children's Waiver. The program will be in effect from January 1, 2017, through March 31, 2027 [Demonstration Services 8].

- Residential and Inpatient Treatment for Individuals with Substance Use Disorder (SUD). Expenditures for Medicaid state plan services furnished to otherwise eligible individuals who are primarily receiving treatment and/or withdrawal management services for substance use disorder (SUD) who are short-term residents in facilities that meet the definition of an institution for mental diseases (IMD).

- Health-Related Social Needs (HRSN) Services. Expenditures for health-related social needs services not otherwise covered that are furnished to individuals who meet the qualifying criteria as described in Section 6. This expenditure authority is contingent on compliance with Section 7, as well as all other applicable STCs.

- Expenditures for HRSN Services Infrastructure. Expenditures for payments for allowable administrative costs and infrastructure not otherwise eligible for Medicaid payment, to the extent such activities are authorized in Section 6 of the STCs. This expenditure authority is contingent on compliance with Section 7 of the STCs, as well as all other applicable STCs.

- Medicaid Hospital Global Budget Initiative. Expenditures for incentive payments to eligible private not-for-profit hospitals with a 0 percent or less operating margin for meeting data collection requirements, reporting expectations, meeting milestones for transitioning to alternative payment models, and demonstrating improvement in health care quality and equity, as specified in the STCs.

- Designated State Health Programs (DSHP). Expenditures for designated programs, described in these STCs (Section 11), which are otherwise state-funded, and not otherwise eligible for Medicaid payment. These expenditures are subject to the terms and limitations and not to exceed specified amounts as set forth in these STCs. These expenditures are specifically contingent on compliance with Section 7, as well as all other applicable STCs.

- Health Equity Regional Organization (HERO). Expenditures for an independent contracted statewide entity designed to develop regionally focused approaches to reduce health disparities, advance health equity, and support the delivery of health-related social needs as described in Section 13.

- Workforce Initiatives. Expenditures for provider student loan repayment and Career Pathway Training programs that meet the criteria as specified in Section 12 of the STCs.

- Time limited expenditure authority is granted until four years following the demonstration, in order for the state to pay close-out administrative and monitoring service commitments.

Title XIX Requirements Not Applicable to the HRSN Expenditure Authorities

Comparability; Amount, Duration, and Scope Section 1902(a)(10)(B), Section 1902(a)(17)

To the extent necessary to enable the state to provide a varying amount, duration, and scope of HRSN services to a subset of beneficiaries, depending on beneficiary needs.

Comparability; Provision of Medical Assistance and Reasonable Promptness 1902(a)(17), 1902(a)(8) Sections 1902(a)(10)(B),

To the extent necessary to allow the state to offer HRSN services to an individual who meets the qualifying criteria for HRSN services, including delivery system enrollment, as described in Section 6 of the STCs.

To the extent necessary to allow the state to delay the application review process for HRSN services in the event the state does not have sufficient funding to support providing these services to eligible beneficiaries.

SPECIAL TERMS AND CONDITIONS

NUMBER: 11-W-00114/2

TITLE: Medicaid Redesign Team

AWARDEE: New York State Department of Health

1. PREFACE

The following are the STCs for the New York Medicaid Redesign Team section 1115(a) Medicaid demonstration (hereinafter "demonstration" or "MRT") to enable the New York State Department of Health (hereinafter "state" or "DOH") to operate this demonstration. The Centers for Medicare & Medicaid Services (CMS) has granted the state waivers of requirements under section 1902(a) of the Social Security Act (hereinafter "the Act") and expenditure authorities authorizing federal matching of demonstration costs that are not otherwise matchable and which are separately enumerated.

These STCs set forth in detail the nature, character, and extent of federal involvement in the Demonstration and New York's obligations to CMS related to this demonstration. The MRT demonstration will be statewide and is approved from April 1, 2022, through March 31, 2027.

The STCs have been arranged into the following sections:

- Preface

- Program Description and Objectives

- General Program Requirements

- Populations Affected by and Eligible Under the Demonstration

- Demonstration Benefits and Enrollment

- Health-Related Social Needs (HRSN) Services

- Provider Payment Rate Increase Requirement

- SUD Program and Benefits

- Medicaid Hospital Global Budget Initiative

- Delivery Systems

- Designated State Health Programs (DSHP)

- Workforce Initiatives

- Health Equity Regional Organization (HERO)

- Monitoring and Reporting Requirements

- General Financial Requirements

- Monitoring Budget Neutrality

- Evaluation of the Demonstration

- Schedule of Deliverables for the Demonstration

Additional attachments have been included to provide supplementary information and for specific STCs.

- Home and Community-Based Services (HCBS) Expansion Program Benefits

- Behavioral Health (BH) HCBS and Community Oriented Recovery and Empowerment (CORE) Services in Health and Recovery Plans (HARP)

- Mandatory Managed Long-Term Care/Care Coordination Model (CCM)

- List of Eligible Goods and Services Under BH HCBS Individual Directed Goods and Services

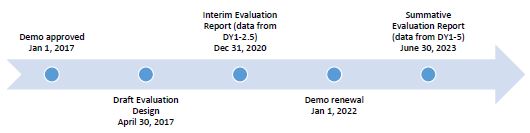

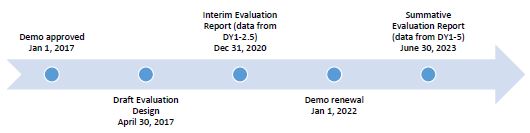

- Developing the Evaluation Design

- Preparing the Interim and Summative Evaluation Reports

- Evaluation Design [Reserved]

- SUD Implementation Plan

- SUD Monitoring Protocol [Reserved]

- HRSN Implementation Plan [Reserved]

- Assessment of Beneficiary Eligibility and Needs, Infrastructure Planning, and Provider Qualifications for HRSN Services Protocol [Reserved]

- Medicaid Hospital Global Budget Initiative Implementation Protocol [Reserved]

- Provider Rate Increase Attestation Table [Reserved]

- Approved List of DSHPs

- DSHP Claiming Protocol [Reserved]

- Monitoring Protocol for Other Policies [Reserved]

- DSHP Sustainability Plan [Reserved]

2. PROGRAM DESCRIPTION AND OBJECTIVES

The state's goal in implementing the Medicaid Redesign Team Section 1115(a) demonstration is to improve access to health services and outcomes for low-income New Yorkers by:

- Improving access to health care for the Medicaid population;

- Improving the quality of health services delivered;

- Expanding coverage with resources generated through managed care efficiencies to additional low-income New Yorkers;

- Advancing health equity, reducing health disparities, and supporting the delivery of HRSN services.

The demonstration is designed to permit New York to use a managed care delivery system to deliver benefits to Medicaid recipients, create efficiencies in the Medicaid program, and enable the extension of coverage to certain individuals who need long term care and supports. It was originally approved in 1997 to enroll most Medicaid recipients into MCOs (Medicaid managed care program). As part of the demonstration's renewal in 2006, authority to require some disabled and aged populations to enroll in mandatory managed care was transferred to a new demonstration, the Federal-State Health Reform Partnership (F-SHRP). Effective April 1, 2014, this authority was restored to this demonstration as F-SHRP was phased out.

In 2001, the Family Health Plus (FHPlus) program was implemented as an amendment to the demonstration, providing comprehensive health coverage to low-income uninsured adults, with and without dependent children, who have income greater than Medicaid state plan eligibility standards. FHPlus was further amended in 2007 to implement an employer sponsored health insurance (ESHI) component. Individuals eligible for FHPlus who have access to cost-effective ESHI are required to enroll in that coverage, with FHPlus providing any wrap-around services necessary to ensure that enrollees get all FHPlus benefits. FHPlus expired on December 31, 2013, and became a state-only program, but federal matching funding for state expenditures for FHPlus will continue to be available as a designated state health program through December 31, 2014.

In 2002, the demonstration was expanded to incorporate a family planning benefit under which family planning and family planning related services were provided to women losing Medicaid eligibility and to certain other adults of childbearing age (family planning expansion program). The family planning expansion program expired on December 31, 2013, and became a state plan benefit.

In 2010, the Home and Community Based Services Expansion program (HCBS Expansion program) was added to the demonstration. It covers cost-effective home and community-based services to certain adults with significant medical needs as an alternative to institutional care in a nursing facility. The benefits and program structure mirrors those of existing section 1915(c) waiver programs and aims to cover quality services for individuals in the community, ensure the well-being and safety of the participants and increase opportunities for self-advocacy and self-reliance.

As part of the 2011 extension, the state was authorized to develop and implement two new initiatives designed to improve the quality of care rendered to Partnership Plan recipients. The first, the Hospital-Medical Home (H-MH) project, provided funding and performance incentives to hospital teaching programs in order to improve the coordination, continuity and quality of care for individuals receiving primary care in outpatient hospital settings and facilitate certification of such programs by the National Committee for Quality Assurance as patient-centered medical homes. This demonstration initiative ended on December 31, 2014.

Under the second 2011 initiative, the state would have provided funding, on a competitive basis, to hospitals and/or collaborations or hospitals and other providers for the purpose of developing and implementing strategies to reduce the rate of Potentially Preventable Readmissions for the Medicaid population. The demonstration initiative was never implemented.

In 2011 CMS began providing matching funding for the state's program to address clinic uncompensated care through its Indigent Care Pool (ICP). This pool expired on December 31, 2014.

In 2012, New York added to the demonstration an initiative to improve service delivery and coordination of long-term care services and supports for individuals through a managed care model. Under the MLTC program, eligible individuals in need of more than 120 days of community-based long-term care are enrolled with managed care providers to receive long term services and supports as well as other ancillary services. Other covered services are available on a fee-for-service basis to the extent that New York has not exercised its option to include the individual in the MMMC program. Enrollment in MLTC was phased in geographically and by group.

The state's goals specific to MLTC are listed below:

- Expanding access to managed long-term care for Medicaid enrollees who are in need of long-term services and supports (LTSS)

- Improving patient safety and quality of care for enrollees in MLTC plans

- Reducing preventable inpatient and nursing home admissions

- Improving satisfaction, safety and quality of life

In April 2013, New York had three amendments approved. The first amendment was a continuation of the state's goal for transitioning more Medicaid beneficiaries into managed care. Under this amendment, the Long-Term Home Health Care Program (LTHHCP) participants began transitioning, on a geographic basis, from New York's 1915(c) waiver into the 1115 demonstration and into managed care. Second, this amendment eliminated the exclusion from MMMC of both foster care children placed by local social service agencies and individuals participating in the Medicaid buy-in program for the working disabled.

Additionally, the April 2013 amendment approved expenditure authority for New York to claim federal financial participation (FFP) for expenditures made for certain DSHP beginning April 1, 2013, through March 31, 2014. These DSHPs were aimed to improve health outcomes for Medicaid and other low-income individuals, and the federal funding was linked to requirements for the state to submit deliverables to demonstrate successful efforts to transform its health system for individuals with developmental disabilities.

A December 2013 amendment was approved to ensure that the demonstration made changes that were necessary in order to coordinate its programs with the Medicaid expansion and other changes made under the Affordable Care Act (ACA) implementation beginning January 1, 2014.

Effective April 1, 2014, CMS approved an amendment to extend several authorities that expired in calendar year 2014. As part of the amendment CMS extended authorities related to the transitioning of parents into state plan coverage and other authorities that provide administrative ease to the state's programs and continuing to provide services to vulnerable populations, i.e. HCBS Expansion program and individuals moved from institutional settings into community-based settings.

Also, effective April 1, 2014, populations receiving managed care or managed long-term care in the 14 counties that encompassed the Federal-State Health Reform Partnership (F-SHRP) demonstration were moved into this demonstration.

An amendment approved on April 14, 2014, allowed New York to take the first steps toward a major delivery system reform through a Delivery System Reform Incentive Payment (DSRIP) program. This amendment to the Partnership Plan demonstration provided for an Interim Access Assurance Fund (IAAF) to ensure that sufficient numbers and types of providers were available in the community to participate in the transformation activities contemplated by the DSRIP Program. The DSRIP program incentivized providers through additional payments beginning in 2015. The amendment also included expenditure authority for DSHPs to allow the state to concentrate resources on the investments necessary to implement its DSRIP program. Savings from the DSRIP program were anticipated to exceed the cost of the DSHP program.

On December 31, 2014, CMS amended the demonstration to enable New York to extend long term nursing facility services to enrollees of New York's MMMC and MLTC populations. Enrollment in MMMC and MLTC was extended to individuals entering residential health care facilities (RHCF) for stays that are classified as permanent. As part of the agreement, the state also instituted an independent LTSS assessment process via an enrollment broker and implemented its Independent Consumer Support Program in areas of the state where services and enrollment were being instituted.

In August 2015, CMS approved New York's request to implement HARP to integrate physical, behavioral health and BH HCBS for Medicaid enrollees with Serious Mental Illness (SMI) and/or SUD to receive services in their own homes and communities. Under the demonstration, HARPs are a separate coverage product that is targeted to Medicaid enrollees that meet need-based criteria for SMI and/or SUD established by the state. HIV SNP under MMMC will also offer BH HCBS services to eligible individuals meeting targeting, risk, and functional needs criteria. All MMMC plans will offer BH benefits in integrated plans including four new demonstration services.

The demonstration was also amended to effectuate eligibility flexibilities for the Adult Group, including allowing adults enrolled in TANF to be enrolled as a demonstration population, without a MAGI determination, extension of continuous eligibility for members of the Adult Group who turn 65 during their continuous eligibility period and temporary coverage for members of the Adult Group who are determined eligible to receive coverage through the Marketplace.

On November 30, 2016, CMS approved an extension of the demonstration, but in response to comments by the state, that extension was rescinded and superseded by a modified approval effective December 7, 2016. In December 2016, the Partnership Plan was renamed New York MRT. The extension included time-limited authorization to extend the DSRIP program first authorized in 2014, through March 31, 2020. The extension also included a new time-limited DSHP authority to the extent that the state increases its Medicaid expenditures through its DSRIP program and achieves metrics that will result in anticipated cost savings that offset the DSHP expenditures. DSHP funding will be phased down over the demonstration period. The DSRIP and DSHP authorities are intended to be a one-time investment in system transformation that can be sustained through ongoing payment mechanisms and/or state and local initiatives.

The Behavioral Health Self-Direction Pilot was included as part of the renewal. This pilot made self-direction services available to HARP and HIV SNP enrollees receiving BH HCBS. The program is authorized to be in effect from January 1, 2017, through March 31, 2027

On April 19, 2019, CMS approved an amendment to allow a waiver of comparability which permits managed care enrollees to only be assessed a drug copay. The state will not assess the non-drug benefit cost sharing described in the Medicaid state plan.

On August 2, 2019, CMS approved an amendment containing the following changes:

- Allow children with HCBS under the state's 1915(c) Children's Waiver and children placed in foster care through a Voluntary Foster Care Agency (VFCA) to enroll in Mainstream Managed Care or an HIV SNP.

- Continues Medicaid eligibility for Non-1915 children who would have been eligible under the Children's Waiver had case management not been moved under the State Plan as a Health Home service or who were in a non-SSI category and receive HCBS or Health Home (HH) comprehensive case management.

- Include Children's Waiver HCBS and State Plan behavioral health services in the Medicaid managed care benefit package.

- Include children receiving HCBS under the Children's waiver in the Self Direction Pilot for Individual Directed Goods and Services.

On December 19, 2019, CMS approved an amendment with the following changes for Partially Capitated MLTC plans:

- Implement a lock-in policy for partially capitated MLTC plans, pursuant to which enrollees of partially capitated MLTC plans are able to transfer to another partially capitated plan without cause during the first 90 days of a 12-month period and with good cause during the remainder of the period. A member of a partially capitated MLTC plan may transfer to another type of MLTC plan at any time.

- Limit the nursing home benefit in the partially capitated MLTC plan to three months for those enrollees who have been designated as Long-Term Nursing Home Stays (LTNHS) in a skilled nursing or residential health care facility, at which time the individual will be involuntarily disenrolled from the partially capitated MLTC plan and payment for nursing home services will be covered by Medicaid fee for service for individuals that qualify for institutional Medicaid coverage. Consistent with this partially capitated MLTC benefit change, individuals age 21 years of age or older who are dually eligible for Medicare and Medicaid and LTNHS in a nursing home will be excluded from enrollment in a partially capitated MLTC plan.

On October 5, 2021, CMS approved an amendment that added a set of rehabilitative services (as such term is defined in Section 1905(a)(13) of the Social Security Act) called CORE, substitutes for and improves upon four BH HCBS within the HARP and HIV SNP. CORE Services can be found in Attachment B and are available to HARP members and HIV SNP members meeting HARP eligibility criteria for whom such services are recommended by a physician or Licensed Practitioner of the Healing Arts as defined by New York State. Through the transition to CORE Services, the state will improve access to rehabilitation and recovery services for HARP beneficiaries. New York State will ensure continuity of care for individuals for BH HCBS including the four services transitioning to CORE. Individuals receiving or eligible for remaining BH HCBS and the BH HCBS, which directly transition to CORE Services will not receive a reduction in services and/or eligibility based on this demonstration amendment. The list of BH HCBS can also be found in Attachment B.

On March 23, 2022, CMS approved a 5-year extension of the New York Medicaid Redesign Team demonstration. As part of the extension, CMS approved the state's second component of its MLTC amendment request to allow dual eligibles to stay in Mainstream Managed Care Plans that offer D-SNPs once they become eligible for Medicare.

On January 9, 2024 CMS approved an amendment that provides authority for HRSN services and HRSN infrastructure, a Medicaid Hospital Global Budget Initiative, workforce initiatives, a HERO, and DSHP. The amendment also provided the state with SUD demonstration authority.

The overarching goal of this amendment is to advance health equity, reduce health disparities, and support the delivery of social care through Social Care Networks (SCNs) and improve overall quality and health. Through the combination of a Medicaid Hospital Global Budget Initiative, HRSN activities, workforce initiatives, and HERO, the state is working to improve health equity. As a result, CMS considers this amendment a Health Equity Initiative. Additionally, by the end of the demonstration, the state's goal is to have made significant movement towards value-based payment (VBP) strategies, multi-payor alignment, and population health accountability. Each program has individual goals that align with the overall goal:

- Investments in Health Related Social Needs (HRSN) via greater integration between primary care providers (PCPs) and community-based organizations (CBOs) with a goal of improved quality and health outcomes;

- Goal of improving quality and outcomes of enrollees in geographies that have a longstanding history of health disparities and disengagement from the health system;

- Focus on integrated primary care, BH, and HRSN with a goal to improve population health and health equity outcomes for high-risk enrollees including kids/youth, pregnant and postpartum individuals, the chronically homeless, and individuals with SMI and SUD;

- Workforce investments with a goal of equitable and sustainable access to care in Medicaid

- Developing regionally-focused approaches, including new value-based payment programs, with a goal of statewide accountability for improving health, outcomes, and equity.

Under the SUD demonstration authority, the state will maintain and enhance access to mental health services, opioid use disorder (OUD) and other SUD services and continue delivery system improvements for these services to provide more coordinated and comprehensive treatment of Medicaid beneficiaries with SUD. The demonstration amendment will provide the state with authority to provide high-quality, clinically appropriate treatment to beneficiaries with SUD while they are short-term residents in residential and inpatient treatment settings that qualify as an IMD. The amendment will also support state efforts to enhance provider capacity, improve the availability of Medication Assisted Treatment (MAT) and improve access to a continuum of SUD evidence-based services at varied levels of intensity, including withdrawal management services.

In alignment with the respective SUD demonstration State Medicaid Director Letter (SMDL)1, under the SUD program, during the demonstration period, the state seeks to achieve the following goals:

SUD Goals:

- Increase rates of identification, initiation, and engagement in treatment for SUD.

- Increase adherence to and retention in treatment.

- Reduce overdose deaths, particularly those due to opioids.

- Reduce utilization of emergency departments and inpatient hospital settings for treatment where the utilization is preventable or medically inappropriate through improved access to other continuum of care services.

- Fewer readmissions to the same or higher level of care where the readmission is preventable or medically inappropriate.

- Improve access to care for physical health conditions among beneficiaries with SUD.

3. GENERAL PROGRAM REQUIREMENTS

- 3.1 Compliance with Federal Non-Discrimination Statutes. The state must comply with all applicable federal statutes relating to non-discrimination. These include, but are not limited to, the Americans with Disabilities Act of 1990 (ADA), Title VI of the Civil Rights Act of 1964, section 504 of the Rehabilitation Act of 1973 (Section 504), the Age Discrimination Act of 1975, and section 1557 of the Patient Protection and Affordable Care Act (Section 1557).

- 3.2 Compliance with Medicaid and Children's Health Insurance Program (CHIP) Law, Regulation, and Policy. All requirements of the Medicaid and CHIP programs expressed in federal law, regulation, and policy statement, not expressly waived or identified as not applicable in the waiver and expenditure authority documents (of which these terms and conditions are part), apply to the demonstration.

- 3.3 Changes in Medicaid and CHIP Law, Regulation, and Policy. The state must, within the timeframes specified in federal law, regulation, or written policy, come into compliance with any changes in law, regulation, or policy affecting the Medicaid or CHIP programs that occur during this demonstration approval period, unless the provision being changed is expressly waived or identified as not applicable. In addition, CMS reserves the right to amend the STCs to reflect such changes and/or changes as needed without requiring the state to submit an amendment to the demonstration under STC 3.7. CMS will notify the state 30 business days in advance of the expected approval date of the amended STCs to allow the state to provide comment. Changes will be considered in force upon issuance of the approval letter by CMS. The state must accept the changes in writing.

- 3.4 Impact on Demonstration of Changes in Federal Law, Regulation, and Policy.

- To the extent that a change in federal law, regulation, or policy requires either a reduction or an increase in federal FFP for expenditures made under this demonstration, the state must adopt, subject to CMS approval, a modified budget neutrality agreement for the demonstration as necessary to comply with such change, as well as a modified allotment neutrality worksheet as necessary to comply with such change. The trend rates for the budget neutrality agreement are not subject to change under this subparagraph. Further, the state may seek an amendment to the demonstration (as per STC 3.7 of this section) as a result of the change in FFP.

- If mandated changes in the federal law require state legislation, unless otherwise prescribed by the terms of the federal law, the changes must take effect on the earlier of the day such state legislation becomes effective, or on the last day such legislation was required to be in effect under the law, whichever is sooner.

- 3.5 State Plan Amendments. The state will not be required to submit title XIX or XXI state plan amendments (SPA) for changes affecting any populations made eligible solely through the demonstration. If a population eligible through the Medicaid or CHIP state plan is affected by a change to the demonstration, a conforming amendment to the appropriate state plan is required, except as otherwise noted in these STCs. In all such cases, the Medicaid and CHIP state plans govern.

- 3.6 Changes Subject to the Amendment Process. Changes related to eligibility, enrollment, benefits, beneficiary rights, delivery systems, cost sharing, sources of non-federal share of funding, budget neutrality, and other comparable program elements must be submitted to CMS as amendments to the demonstration. All amendment requests are subject to approval at the discretion of the Secretary in accordance with section 1115 of the Act. The state must not implement changes to these elements without prior approval by CMS either through an approved amendment to the Medicaid or CHIP state plan or amendment to the demonstration. Amendments to the demonstration are not retroactive and no FFP of any kind, including for administrative or medical assistance expenditures, will be available under changes to the demonstration that have not been approved through the amendment process set forth in STC 3.7 below, except as provided in STC 3.3.

- 3.7 Amendment Process. Requests to amend the demonstration must be submitted to CMS for approval no later than 120 calendar days prior to the planned date of implementation of the change and may not be implemented until approved. CMS reserves the right to deny or delay approval of a demonstration amendment based on non-compliance with these STCs, including but not limited to the failure by the state to submit required elements of a complete amendment request as described in this STC, and failure by the state to submit required reports and other deliverables according to the deadlines specified therein. Amendment requests must include, but are not limited to, the following:

- An explanation of the public process used by the state, consistent with the requirements of STC 3.12. Such explanation must include a summary of any public feedback received and identification of how this feedback was addressed by the state in the final amendment request submitted to CMS;

- A detailed description of the amendment, including impact on beneficiaries, with sufficient supporting documentation;

- A data analysis which identifies the specific "with waiver" impact of the proposed amendment on the current budget neutrality agreement. Such analysis must include current total computable "with waiver" and "without waiver" status on both a summary and detailed level through the current approval period using the most recent actual expenditures, as well as summary and detailed projections of the change in the "with waiver" expenditure total as a result of the proposed amendment, which isolates (by Eligibility Group) the impact of the amendment;

- An up-to-date CHIP allotment worksheet, if necessary;

- The state must provide updates to existing demonstration reporting and quality and evaluation plans. This includes a description of how the evaluation design and annual progress reports will be modified to incorporate the amendment provisions, as well as the oversight, monitoring and measurement of the provisions.

3.8 Extension of the Demonstration. States that intend to request an extension of the demonstration must submit an application to CMS at least 12 months in advance from the Governor or Chief Executive Officer of the state in accordance with the requirements of 42 CFR 431.412(c). States that do not intend to request an extension of the demonstration beyond the period authorized in these STCs must submit phase-out plan consistent with the requirements of STC 3.9. 3.9 Demonstration Phase-Out. The state may only suspend or terminate this demonstration in whole, or in part, consistent with the following requirements.

- Notification of Suspension or Termination: The state must promptly notify CMS in writing of the reason(s) for the suspension or termination, together with the effective date and a transition and phase-out plan. The state must submit a notification letter and a draft transition and phase-out plan to CMS no less than six months before the effective date of the demonstration's suspension or termination. Prior to submitting the draft transition and phase-out plan to CMS, the state must publish on its website the draft transition and phase-out plan for a 30-day public comment period. In addition, the state must conduct tribal consultation in accordance with STC 3.12, if applicable. Once the 30-day public comment period has ended, the state must provide a summary of the issues raised by the public during the comment period and how the state considered the comments received when developing the revised transition and phase-out plan.

- Transition and Phase-out Plan Requirements: The state must include, at a minimum, in its phase-out plan the process by which it will notify affected beneficiaries, the content of said notices (including information on the beneficiary's appeal rights), the process by which the state will conduct administrative reviews of Medicaid or CHIP eligibility prior to the termination of the demonstration for the affected beneficiaries, and ensure ongoing coverage for eligible beneficiaries, as well as any community outreach activities the state will undertake to notify affected beneficiaries, including community resources that are available.

- Transition and Phase-out Plan Approval. The state must obtain CMS approval of the transition and phase-out plan prior to the implementation of transition and phase-out activities. Implementation of transition and phase-out activities must be no sooner than 14 calendar days after CMS approval of the transition and phase-out plan.

- Transition and Phase-out Procedures: The state must redetermine eligibility for all affected beneficiaries in order to determine if they qualify for Medicaid eligibility under a different eligibility category prior to making a determination of ineligibility as required under 42 CFR 35.916(f)(1), or for children in CHIP consider eligibility for other insurance affordability programs under 42 CFR 457.350. For individuals determined ineligible for Medicaid and CHIP, the state must determine potential eligibility for other insurance affordability programs and comply with the procedures set forth in 42 CFR 435.1200(e). The state must comply with all applicable notice requirements for Medicaid found in 42 CFR, part 431 subpart E, including Sections 431.206 through 431.214 or for CHIP found at 42 CFR 457.340(e), including information about a right to review consistent with 42 CFR 457.1180. In addition, the state must assure all applicable Medicaid appeal and hearing rights are afforded to Medicaid beneficiaries in the demonstration as outlined in 42 CFR, part 431 subpart E, including Sections 431.220 and 431.221. If a beneficiary in the demonstration requests a hearing before the date of action, the state must maintain Medicaid benefits as required in 42 CFR § 431.230.

- Exemption from Public Notice Procedures 42 CFR Section 431.416(g). CMS may expedite the federal and state public notice requirements under circumstances described in 42 CFR 431.416(g).

- Enrollment Limitation during Demonstration Phase-Out. If the state elects to suspend, terminate, or not extend this demonstration, during the last six months of the demonstration, enrollment of new individuals into the demonstration must be suspended. The limitation of enrollment into the demonstration does not impact the state's obligation to determine Medicaid eligibility in accordance with the approved Medicaid state plan.

- FFP. If the project is terminated or any relevant waivers are suspended by the state, FFP must be limited to normal closeout costs associated with the termination or expiration of the demonstration including services, continued benefits as a result of beneficiaries' appeals, and administrative costs of disenrolling beneficiaries.

3.10 Withdrawal of Waiver or Expenditure Authority. CMS reserves the right to withdraw waivers and/or expenditure authorities at any time it determines that continuing the waiver or expenditure authorities would no longer be in the public interest or promote the objectives of title XIX and title XXI. CMS will promptly notify the state in writing of the determination and the reasons for the withdrawal, together with the effective date, and afford the state an opportunity to request a hearing to challenge CMS' determination prior to the effective date. If a waiver or expenditure authority is withdrawn, FFP is limited to normal closeout costs associated with terminating the waiver or expenditure authority, including services, continued benefits as a result of beneficiary appeals, and administrative costs of disenrolling beneficiaries. 3.11 Adequacy of Infrastructure. The state will ensure the availability of adequate resources for implementation and monitoring of the demonstration, including education, outreach, and enrollment; maintaining eligibility systems; compliance with cost sharing requirements; and reporting on financial and other demonstration components. 3.12 Public Notice, Tribal Consultation, and Consultation with Interested Parties. The state must comply with the state notice procedures as required in 42 CFR 431.408 prior to submitting an application to extend the demonstration. For applications to amend the demonstration, the state must comply with the state notice procedures set forth in 59 Fed. Reg. 49249 (September 27, 1994) prior to submitting such request. The state must also comply with the Public Notice Procedures set forth in 42 CFR 447.205 for changes in statewide methods and standards for setting payment rates.

- The state must also comply with tribal and Indian Health Program/Urban Indian Organization consultation requirements at section 1902(a)(73) of the Act, 42 CFR 431.408(b), State Medicaid Director Letter #01-024, or as contained in the state's approved Medicaid State Plan, when any program changes to the demonstration, either through amendment as set out in STC 3.7 or extension, are proposed by the state.

3.13 FFP. No federal matching funds for expenditures for this demonstration, including for administrative and medical assistance expenditures, will be available until the effective date identified in the demonstration approval letter, or if later, as expressly stated within these STCs. 3.14 Administrative Authority. When there are multiple entities involved in the administration of the demonstration, the Single State Medicaid Agency must maintain authority, accountability, and oversight of the program. The State Medicaid Agency must exercise oversight of all delegated functions to operating agencies, MCOs, and any other contracted entities. The Single State Medicaid Agency is responsible for the content and oversight of the quality strategies for the demonstration. 3.15 Common Rule Exemption. The state must ensure that the only involvement of human subjects in research activities that may be authorized and/or required by this demonstration is for projects which are conducted by or subject to the approval of CMS, and that are designed to study, evaluate, or otherwise examine the Medicaid or CHIP program - including public benefit or service programs, procedures for obtaining Medicaid or CHIP benefits or services, possible changes in or alternatives to Medicaid or CHIP programs and procedures, or possible changes in methods or levels of payment for Medicaid benefits or services. CMS has determined that this demonstration as represented in these approved STCs meets the requirements for exemption from the human subject research provisions of the Common Rule set forth in 45 CFR 46.104(d)(5). 4. POPULATIONS AFFECTED BY AND ELIGIBILITY UNDER THE DEMONSTRATION

- 4.1 Eligible under the Medicaid State Plan (State Plan Eligibles). Mandatory and optional Medicaid state plan populations derive their eligibility through the Medicaid state plan and are subject to all applicable Medicaid laws and regulations in accordance with the Medicaid state plan, except as expressly waived and as further described in these STCs. Should the state amend the state plan to make any changes to eligibility for Medicaid mandatory populations, upon submission of the state plan amendment, the state must notify CMS in writing of the pending state plan amendment. The Medicaid Eligibility Groups (MEGs) listed in the Reporting and the Budget Neutrality sections of the STCs will be updated upon approval of changes to State plan eligibility and will be considered a technical change to the STCs.

- 4.2 Individuals Not Otherwise Eligible under the Medicaid State Plan. Beneficiary eligibility groups who are made eligible for the demonstration by virtue of the expenditure authorities expressly granted in this demonstration are subject to Medicaid laws or regulations, except for those identified as non-applicable in the expenditure authorities for this document. Eligibility criteria are described elsewhere in this section. Individuals made eligible under this demonstration by virtue of the expenditure authorities expressly granted include:

- Individuals in the HCBS Expansion program;

- Individuals moved from Institutional Settings to Community Settings and receiving MLTC but who would have excess income or resources under the state plan;

- Adults who are receiving TANF benefits and have not been determined eligible using MAGI-based methods;

- Individuals previously eligible in the adult group who are no longer eligible in that group but are still within a 12-month continuous eligibility period;

- Children under age 21 who are medically needy (both Supplemental Security Income (SSI)-related and non-SSI related) and have parental income and resources (if applicable) waived and otherwise meet eligibility criteria for 1915(c) waiver #.4125 as Fo1 Demonstration children;

- People who are not eligible under the Children's waiver. Note: Unlike the Fo1 Children's (Demonstration Population 12) expenditures authorized under section 1115(a)(2) in these STCs, additional Family of One Children (SSI-related) that receive their HCBS under the state's Children's 1915(c) Waiver do not require this demonstration's expenditure authority.

- 4.3 Program Components. The Medicaid Redesign demonstration includes two distinct components–MMMC and MLTC –each of which affects different populations, some of which are eligible under the state plan and some of which are eligible only as an expansion population underthe demonstration. In addition, subsets of MMMC and MLTC are eligible for additional benefits. Table 1 summarizes the Medicaid state plan populations that are affected by the demonstration. In addition, the following expansion populations must participate in MLTC: Demonstration Population 9 (HCBS Expansion) and Demonstration Population 10 (Institution to Community). More detailed descriptions follow.

Table 1: State Plan Populations Affected by the Demonstration State Plan Mandatory and Optional Groups MMMC: Medicaid-eligible; not otherwise excluded from MMMC enrollment (includes HARP and SNP for eligible individuals) MLTC: Need more than 120 days of community-based long-term care services Pregnant Women Pregnant women (42 CFR §435.116) Income up to 218% of FPL Pregnant minors under age 21 (42 CFR §435.222) No income test Demonstration Population 2 [TANF Adult] Without Medicare: Demonstration Population 5 [Non-Duals 18-64] With Medicare: Demonstration Population 7 [MLTC Adult Age 18-64 Duals] Children Infants (218% FPL) and children under age 19 (149% FPL) (42 CFR §435.117 and §435.118) Demonstration Population 1 [TANF Child] N/A Children age 19 and 20 (42 CFR §435.222) Income up to 133% of FPL if living alone and 150% if living with parents Demonstration Population 1 TANF CHILD Without Medicare: Demonstration Population 5 [Non-Duals 18-64] With Medicare: Demonstration Population 7 [MLTC Adult Age 18-64 Duals] Medically needy children age 19 and 20 (42 CFR §435.308) Income at or below the monthly income standard or with spenddown N/A Without Medicare: Demonstration Population 5 [Non-Duals 18-64] With Medicare: Demonstration Population 7 [MLTC Adult Age 18-64 Duals] Adults Adult group (42 CFR §435.119) Over age 18, under age 65, non-disabled, non-pregnant with income up to 133% of FPL, not eligible for Medicare Part A or B benefits, not eligible under the parents and other caretaker relative group, the foster care child group, or the former foster care child group. Demonstration Population 11 [New Adult Group] New Adult Group: Demonstration Population 11 Parents and Caretakers Parents and other caretaker relatives (42 CFR §435.110 and §435.220) Income up to 133% of FPL Includes low-income adults enrolled in TANF who are exempt from receiving a MAGI determination in accordance with §1902(e)(14)(D)(i)(I) of the Act. Includes Transitional Medical Assistance under sections 1902(a)(52) and (e)(1); 1925; and 1931(c)(2) of the Social Security Act Demonstration Population 2 [TANF Adult] Without Medicare: Demonstration Population 5 [Non-Duals 18-64] With Medicare: Demonstration Population 7 [MLTC Adult Age 18-64 Duals] Medically needy parents and other caretaker relatives (42 CFR §435.310) Income at or below the monthly income standard or with spenddown N/A Without Medicare, Demonstration population 5 [Non-Duals 18-64] With Medicare, Demonstration population 7 [MLTC Adult Age 18-64 Duals] Disabled Blind and disabled individuals age 64 and under receiving SSI (42 CFR §435.120) Voluntarily enrolled or required to enroll in managed care in those counties participating in the MRT (formerly Partnership Plan) as of October 1, 2006, Demonstration Population 3 [SSI 0 through-64] Without Medicare, Demonstration Population 5 [Non-Duals 18-64] With Medicare, Demonstration Population 7 [MLTC Adults 18-64 Duals] Medically needy adults/children aged 18 through 64 blind and disabled (42 CFR §435.322 and §324) Income at or below the monthly income standard, or with spend down to monthly income standard N/A Without Medicare, Demonstration Population 5 [Non-Duals 18-64] With Medicare, Demonstration Population 7 [MLTC Adults 18-64 Duals] Aged 18 through 64 Medicaid Buy In for Working People with Disabilities Income up to 250% of FPL Demonstration Population 2 [TANF Adult] Without Medicare, Demonstration Population 5 [Non-Duals 18-64] With Medicare, Demonstration Population 7 [MLTC Adults 18-64 Duals] Aged Aged Individuals Age 65 and Over Receiving SSI (42 CFR §435.120) Optional Adults aged 65 or older (42 CFR §435.210) Voluntarily enrolled or required to enroll in managed care in those counties participating in the MRT (formerly Partnership Plan) as of October 1, 2006, Demonstration Population 4, [SSI 65 and above] Without Medicare, Demonstration Population 6 [Non-Duals 65+] With Medicare, Demonstration Population 8 [MLTC age 65+ Duals] Medically needy age 65 and over (42 CFR §435.320) Income at or below the monthly income standard, or with spend down to monthly income standard N/A Without Medicare, Demonstration Population 6 [Non-Duals 65+] With Medicare, Demonstration Population 8 [MLTC age 65+ Duals] Foster Care Children with adoption assistance, foster care or guardianship under title IV-E (42 CFR §435.145)

No income testDemonstration Population 1 [TANF Child] N/A Children in state foster care Children receiving non IV-E guardianship assistance (42 CFR §435.222)

No income testDemonstration Population 1 [TANF Child] N/A Former foster care children up to age 26 (42 CFR §435.150)

No income testDemonstration Population 1 [TANF Child] N/A Independent Foster Care Adolescents 18 through 20 (In foster care on the date of 18th birthday) (42 CFR §435.226

No income testDemonstration Population 1 [TANF Child] Without Medicare, Demonstration Population 5 [Non-Duals 18-64] With Medicare, Demonstration Population 7 [MLTC Adults 18-64 Duals] Children receiving state adoption assistance (42 CFR 435.227) No income test Demonstration Population 1 [TANF Child] N/A

- MMMC. This component provides Medicaid state plan and demonstration benefits through a managed care delivery system comprised of MCOs and primary care case management (PCCM) arrangements to most recipients eligible under the state plan. All state plan eligibility determination rules apply to these individuals.

- Eligibility. Table 1 above lists the groups of individuals who receive Medicaid benefits through the mainstream Medicaid managed care component of the demonstration, as well as the relevant expenditure reporting category (demonstration population) for each.

- Exclusions and Exemptions from MMMC. Notwithstanding the eligibility criteria in STC 4.3, certain individuals cannot receive benefits through the MMMC program (i.e., excluded), while others may opt out from receiving benefits through the MMMC program (i.e., exempted). Excluded individuals are outside the demonstration and are not included in Demonstration Populations. Exempt individuals are included in the demonstration and in Demonstration Populations regardless of whether they enroll in managed care. Tables 2 and 3 list those individuals either excluded or exempted from MMMC.

* Aliessa Aliens are NOT excluded from Managed Care but are excluded from FFP.

Table 2: Individuals Excluded from MMMC (including HARP and HIV SNP) Individuals who become eligible for Medicaid only after spending down a portion of their income Residents of state psychiatric facilities and residents of Residential Treatment Facilities for Children and Youth Individuals under age 21 who are permanent residents of Residential Health Care Facilities or temporary residents of Residential Health Care Facilities at time of enrollment Medicaid eligible infants living with incarcerated mothers Youth in Office of Children and Family Services (OCFS) facilities and in the care and custody of the Office of Family & Children Services Individuals with access to comprehensive private health insurance Certified blind or disabled children living or expected to live separate and apart from their parents for 30 days or more Individuals expected to be Medicaid eligible for less than 6 months (except for pregnant women) Individuals receiving hospice services (at time of enrollment) Individuals with a "county of fiscal responsibility" code of 97, except for individuals in the New York Office of Mental Health family care program who other than their residence in district 97 would be eligible to enroll in MMMC Individuals with a "county of fiscal responsibility" code of 98 including Individuals in an Office for People with Developmental Disabilities (OPWDD) facility or treatment center Individuals who are under 65 years of age (screened and require treatment) in the Centers for Disease Control and Prevention breast, cervical, colorectal or prostate cancer, and who are not otherwise covered under creditable health coverage (Individuals with a "county of responsibility" code of 99) Individuals who are eligible for Emergency Medicaid Aliessa Court Ordered Individuals* Residents of Assisted Living Programs

Table 3: Individuals who may be exempted from MMMC (including HARP and HIV SNP) Individuals with chronic medical conditions who have been under active treatment for at least 6 months with a sub-specialist who is not a network provider for any Medicaid MCO in the service area or whose request has been approved by the New York State Department of Health Medical Director because of unusually severe chronic care needs. Exemption is limited to six months. Child and Youth residents of Residential Rehabilitation Services for Youth (RRSY). Note: as the RRSY services are phased into managed care through contract amendments, the children in RRSYs will mandatorily phase into the demonstration. Individuals designated as participating in Office for People with Developmental Disabilities (OPWDD)-sponsored programs Medicare recipients who enroll and remain enrolled in the MMMC plan's aligned Medicare D-SNP Native Americans Individuals in the following Section 1915(c) waiver programs: Traumatic Brain Injury (TBI) and Nursing Home Transition & Diversion (NHTD) Individuals in the Office for People with Developmental Disabilities Home and Community Based Services (OPWDD HCBS) Section 1915(c) waiver program - MLTC. This component provides a limited set of Medicaid state plan benefits including long-term services and supports through a managed care delivery system to individuals eligible through the state plan who require more than 120 days of community-based long-term care services as indicated on the uniform assessment tool. See Attachment B for a listing of MLTC services. Services not provided through the MLTC program are provided on a fee-for-service basis. The state has authority to expand mandatory enrollment into MLTC to all individuals identified in under the MLTC column in Table 1 (except those otherwise excluded or exempted as outlined in 3(a)(ii) of this section).

- Eligibility for MLTC. Table 1 above lists the groups of individuals who may be enrolled in the Managed Long Term Care component of the demonstration as well as the relevant expenditure reporting category (demonstration population) for each. To be eligible, all individuals in this program must need more than 120 days of community-based long-term care services and for MAP and PACE also have a nursing home level of care.

- Exclusions and Exemptions from MLTC. Notwithstanding the eligibility criteria in STC 3 of this section, certain individuals cannot receive benefits through the MLTC program (i.e., excluded) while others may request an exemption from receiving benefits through the MLTC program (i.e. exempted). Excluded individuals are outside the demonstration, and are not included in Demonstration Populations. Exempt individuals are included in the demonstration and in Demonstration Populations regardless of whether they enroll in managed care. Tables 4 and 5 list those individuals either excluded or exempted from MLTC.

- Non-duplication of Payment. MLTC Programs will not duplicate services included in an enrollee´s Individualized Education Program under the Individuals with Disabilities Education Act, or services provided under the Rehabilitation Act of 1973.

* Aliessa Aliens are NOT excluded from Managed Care but are excluded from FFP.

Table 4: Individuals excluded from MLTC Residents of psychiatric facilities (stays exceeding 30 days) Residents of skilled nursing or residential health care facilities who have been designated as Long Term Nursing Home Stays (LTNHS) in such facility are excluded from enrollment in a partially capitated MLTC plan. Residents of skilled nursing or residential health care facilities who are enrolled in a partially capitated MLTC plan are ineligible to continue their MLTC plan enrollment if they are LTNHS for more than three months. Individuals expected to be Medicaid eligible for less than six months Individuals eligible for Medicaid benefits only with respect to tuberculosis-related services Individuals with a "county of fiscal responsibility" code 99 in Medicaid Management Information System (MMIS) (Individuals eligible only for breast and cervical cancer services) Individuals receiving hospice services (at time of enrollment) Individuals with a "county of fiscal responsibility" code of 97 (Individuals residing in a state Office of Mental Health facility) Individuals with a "county of fiscal responsibility" code of 98 including Individuals in an Office for People with Developmental Disabilities (OPWDD) facility or treatment center Individuals who are under 65 years of age (screened and require treatment) in the Centers for Disease Control and Prevention (CDC) breast, cervical, colorectal and/or prostate early detection program and need treatment for breast, cervical, colorectal or prostate cancer and who are not otherwise covered under creditable health coverage Residents of intermediate care facilities for individuals with intellectual disabilities (ICF/IID) Individuals who could otherwise reside in an ICF/IID, but choose not to Residents of alcohol/substance abuse long term residential treatment programs Individuals eligible for Emergency Medicaid Individuals in the Office for People with Developmental Disabilities Home and Community Based Services (OPWDD HCBS) section 1915(c) waiver program Individuals in the following section 1915(c) waiver programs: Traumatic Brain Injury (TBI), Nursing Home Transition & Diversion (NHTD) (see Attachment C) Residents of Assisted Living Programs Individuals in receipt of Limited Licensed Home Care Services Individuals in the Foster Family Care Demonstration Aliessa Court Ordered Individuals*

Table 5: Individuals who may be exempted from MLTC Individuals aged 18 through 20 who are nursing home certifiable and require more than 120 days of community based long term care services Native Americans Individuals who are eligible for the Medicaid buy in for the working disabled and are nursing home certifiable - Home and Community Based Services Expansion Program (HCBS Expansion). This component provides home and community-based services similar to those provided under the state´s section 1915(c) HCBS waivers (Nursing Home Transition and Diversion Program/NHTD, and Traumatic Brain Injury Program/TBI) to certain medically needy individuals. These services enable these individuals to live at home with appropriate supports rather than in a nursing facility. See Attachment C for HCBS Expansion services. All HCBS Expansion individuals will be transitioned as appropriate to MLTC.

- Eligibility for the HCBS Expansion. This group, identified as Demonstration Population 9/HCBS Expansion, includes married medically needy individuals2:

- who meet a nursing home level of care;

- whose spouse lives in the community; and

- who would be income-eligible for Medicaid services in the community but for the application of the spousal impoverishment eligibility and post-eligibility rules of section 1924 of the Act.

- HARP: This component provides integrated Medicaid covered services and services specifically to address the needs of individuals with a SMI and SUD conditions under the demonstration. Members enrolled in the Health and Recovery Plans described below may elect to remain enrolled in mainstream MCOs. Within the HARPs, a benefit package of BH HCBS and Community Oriented Recovery and Empowerment (CORE) Services are provided, in addition to the existing MMMC benefit package (excluding long term nursing facility services). See Attachment B for a listing of BH HCBS and CORE Services.

- Eligibility for HARP. Eligible individuals include Medicaid adult beneficiaries age 21 or over eligible for Medicaid furnished in MMMC under the demonstration with a specified SMI and/or serious SUD diagnosis and who meet categorical criteria or risk factors specified by New York's Office of Mental Health (OMH) or New York's Office of Addiction Services and Supports (OASAS) identified by a:

- review of behavioral health service utilization, or

- receipt of a qualifying score on a state-approved assessment tool.

- 4.4 Population-Specific Program Requirements

- MMMC Enrollment of Individuals Living with HIV. The state is authorized to require individuals living with HIV to receive benefits through MMMC. Individuals living with HIV will have 30 days in which to select a health plan. If no selection is made, the individual will be auto-assigned to an MCO. Individuals living with HIV who are enrolled in an MCO (voluntarily or by default) may request transfer to an HIV SNP at any time if one or more HIV SNPs are in operation in the individual's district. Further, transfers between HIV SNPs will be permitted at any time. Individuals in HIV SNPs will be eligible for BH HCBS if meeting the targeting, risk and functional needs requirements for BH HCBS. Individuals in HIV SNPs will be eligible for CORE if they otherwise would meet HARP eligibility criteria. HIV SNPs will meet all requirements of MMMC plans providing LTSS as well as HARP plans relating to delivery of BH HCBS and CORE.

- Restricted Recipient Programs. The state may require individuals participating in a restricted recipient program administered under 42 CFR 431.54(e) to enroll in MMMC or MLTC. Furthermore, MCOs may establish and administer restricted recipient programs, through which they identify individuals that have utilized Medicaid services at a frequency or amount that is not medically necessary, as determined in accordance with utilization guidelines established by the state, and restrict them for a reasonable period of time to obtain Medicaid services from designated providers only. The state must adhere to the following terms and conditions in this regard.

- Restricted recipient programs operated by MCOs must adhere to the requirements in 42 CFR 431.54(e) (1) through (3), including the right to a hearing conducted by the state.

- The state must require MCOs to report to the state whenever they want to place a new person in a restricted recipient program. The state must maintain summary statistics on the numbers of individuals placed in restricted recipient programs, and the reasons for those placements, and must provide the information to CMS upon request.

- Individuals Moved from Institutional Settings to Community Settings for Long Term Services and Supports. Individuals discharged from a nursing facility who enroll into or remain enrolled in the MLTC program in order to receive community based long term services and supports or who move from an adult home as defined in subdivision 25 of section 2 of the social services law, to the community and, if applicable, enroll into the MLTC program, are eligible based on a special income standard. The special income standard is also available to MLTC members who were enrolled in the program as a result of the mandatory Nursing Facility transition, and subsequently able to be discharged to the community from the nursing facility, with the services of MLTC program in place. For married individuals who meet the criteria to be considered an "institutionalized spouse," spousal impoverishment rules shall apply. Eligibility is not based on the special income standard for individuals subject to spousal impoverishment rules. The special income standard will be determined by utilizing the average Department of Housing and Urban Development (HUD) Fair Market Rent (FMR) dollar amounts for each of the seven regions in the state, and subtracting from that average, 30 percent of the Medicaid income level (as calculated for a household of one) that is considered available for housing. The seven regions of the state include: Central, Northeastern, Western, Northern Metropolitan, New York City, Long Island and Rochester.

The state shall work with Nursing Home Administrators, nursing home discharge planning staff, family members and the MLTC health plans to identify individuals who may qualify for the housing disregard as they are able to be discharged from a nursing facility back into the community and remain enrolled in or newly enrolled into the MLTC program.

Enrollees receiving community based long term services and supports must be provided with nursing facility coverage through managed care, if nursing facility care is needed for 120 days or less and there is an expectation that the enrollee will return to community-based settings. During the short-term nursing facility stay, the state must retain the enrollees' community maintenance needs allowance. In addition, the state will ensure that the MLTC MCOs work with individuals, their families, nursing home administrators, and discharge planners to help plan for the individual's move back into the community, as well as to help plan for the individual's medical care once he/she has successfully moved into his/her home. For dually eligible enrollees, the MCO is responsible for implementing and monitoring the plan of care between Medicare and Medicaid. The MCO must assure the services are available to the enrollee.- Continuous Eligibility Period

- Duration. The state is authorized to provide a 12-month continuous eligibility period to the groups of individuals specified in Table 6, regardless of the delivery system through which they receive Medicaid benefits. Each newly eligible individual's 12-month period shall begin at the initial determination of eligibility; for those individuals who are re-determined eligible consistent with Medicaid state plan rules, the 12-month period begins at that point. At each annual eligibility redetermination thereafter, if an individual is re-determined eligible under the Medicaid state plan the individual is guaranteed a subsequent 12-month continuous eligibility period. 12-month continuous eligibility is also authorized for the Adult Group under section 1902(a)(10)(A)(i)(VIII) of the Act.

- Exceptions. Notwithstanding subparagraph (a), if any of the following circumstances occur during an individual's 12-month continuous eligibility period, the individual's Medicaid eligibility shall be terminated, suspended or re-determined:

- The individual cannot be located;

- The individual is no longer a New York State resident;

- The individual requests termination of eligibility;

- The individual dies;

- The individual fails to provide, or cooperate in obtaining a Social Security Number, if otherwise required;

- The individual provided an incorrect or fraudulent Social Security Number;

- The individual was determined eligible for Medicaid in error;

- The individual is receiving treatment in a setting where Medicaid eligibility is not available (e.g. institution for mental disease);

- The individual is receiving care, services or other supplies under a section 1915 waiver;

- The individual was previously otherwise qualified for emergency medical assistance benefits only, based on immigration status, but is no longer qualified because the emergency has been resolved;

- The individual fails to provide the documentation of citizenship or immigration status required under federal law;

- The individual is incarcerated;

- The individual turns 65 years of age and is no longer eligible for the Adult Group;

- The individual policy holder fails to provide documentation of third-party health insurance.

Table 6: Groups Eligible for a 12 Month Continuous Eligibility Period State Plan Mandatory and Optional Groups Statutory or Regulatory Reference Individuals determined eligible as pregnant women 42 CFR § 435.116 Individuals determined eligible as the Adult Group 42 CFR § 435.119 Individuals determined eligible as parents or other caretaker relatives 42 CFR § 435.110 Low-income families, except for children § 1931 of the SSA 5. DEMONSTRATION BENEFITS AND ENROLLMENT

- 5.1 Alternative Benefit Plan. The Affordable Care Act Adult Group will receive benefits provided through the state's approved Alternative Benefit Plan (ABP) SPA.

- 5.2 Demonstration Benefits. The following benefits are provided through the indicated delivery system to individuals eligible for the Medicaid managed care components of the demonstration:

- MMMC. State plan and demonstration benefits are delivered through MCOs with the exception of certain services carved out of the MMMC contract and delivered directly by the state on a fee-for-service basis. All MMMC benefits (regardless of delivery method), as well as the co-payments charged to MMMC recipients. In addition to state plan benefits, there are three demonstration services provided only to all enrollees in MMMC under the demonstration.

- Cost Sharing for MMMC. MMMC beneficiaries including HARPs and HIV-SNPs, who are not otherwise exempt from cost sharing consistent with 447.56(a)(1), will be charged drug copays that are approved in the Medicaid state plan. MMMC beneficiaries will not be subject to any non-drug copays that are described in the Medicaid state plan.

- Children's HCBS. MMMC plans will provide HCBS for children not otherwise excluded or exempted from MMMC under the concurrent authority of the 1915(c) Children's waiver and this 1115 demonstration. Independent assessments and person-centered services planning for HCBS under the Children's waiver will be conducted by a State Plan Health Home provider or the state's Independent Entity as described and included in the approved Children's waiver. All HCBS benefits are listed in the approved Children's waiver or the approved State Plan for Community First Choice Option (CFCO). All reimbursement for Children's Waiver HCBS will be non-risk for the first 24 months subject to the non-risk UPL at 42 CFR 447.362. The MCO must pay the FFS fee schedule for non-risk services as long as the HCBS are non-risk (i.e., 24 months). There are no co-payments for Children's waiver services.

- Managed Long Term Care. State plan benefits are delivered through MCOs or, in certain districts, prepaid inpatient health plans, with the exception of certain services carved out of the MLTC contract and delivered directly by the state on a fee-for-service basis.

- For those individuals receiving a nursing home benefit in the partially capitated MLTC plan they will be limited to three months for those enrollees who have been designated as LTNHS in a skilled nursing or residential health care facility as of the effective date of this amendment. After three months the individual will be involuntarily disenrolled from the partially capitated MLTC plan and payment for nursing home services will be covered by Medicaid fee for service for individuals who qualify for institutional Medicaid coverage.

- Should an individual prefer discharge–and an assessment of the individual's medical needs indicates they may be safely discharged to the community–they may remain enrolled in their MLTC plan, while residing in the nursing home on a temporary basis for more than three months, until their discharge plans are resolved, and the individual is transitioned out of the nursing home.