2014-15 Executive Budget and Global Cap Update

February 5, 2014

- Update is also available in Portable Document Format (PDF, 478KB)

Agenda

- 2013-14 Global Cap Recap

- 2014-15 Global Cap Projections

- MRT Phase IV Recommendations

- Other Programs/Proposals in the Global Cap

- Article VII Highlights

2013-14 Global Cap Recap

2013-14 Global Cap Recap

- Reflects annual growth of $512 million (primarily for price and utilization).

- $730 million in resources will be transferred from the Global Cap to stabilize Mental Hygiene funding:

- Part of the $1.1 billion revenue shortfall for developmental disability services.

- Health care coverage will be provided to an additional 127,000 fragile and low income recipients; excludes impact of the ACA.

- Monthly Global Cap Report was expanded:

- Through November spending under the Global Cap was $59 million below estimates; primarily due to:

- Lower category of service spending ($80 million), administrative costs ($27 million), and State operations ($9 million); offset by

- Higher accounts receivable balances ($25 million) and an advanced SUNY IGT payment ($23 million).

- Health care coverage was provided to an additional 102,000 fragile and low income recipients through November:

- Medicaid Managed Care enrollment increased by 120,000 recipients.

- Fee for Service enrollment decreased by 18,000 recipients.

• Medicaid expenditures through November 2013 are $59 million or 0.5% below projections.

| Medicaid Spending November 2013 (dollars in millions) |

|||

|---|---|---|---|

| Category of Service | Estimated | Actual | Variance |

| Total Fee For Service | $6,892 | $6,762 | ($130) |

| Inpatient | $1,946 | $1,924 | ($22) |

| Outpatient/Emergency Room | $336 | $303 | ($33) |

| Clinic | $416 | $463 | $47 |

| Nursing Homes | $2,259 | $2,271 | $12 |

| Other Long Term Care | $826 | $770 | ($56) |

| Non‐Institutional | $1,109 | $1,031 | ($78) |

| Medicaid Managed Care | $7,431 | $7,494 | $63 |

| Family Health Plus | $655 | $642 | ($13) |

| Medicaid Administration Costs | $349 | $322 | ($27) |

| Medicaid Audits | ($391) | ($378) | $13 |

| OHIP Budget / State Operations | $87 | $78 | ($9) |

| All Other | $1,214 | $1,258 | $44 |

| Local Funding Offset | ($5,042) | ($5,042) | $0 |

| TOTAL | $11,195 | $11,136 | ($59) |

• Medicaid enrollment through November 2013 increased by 102,068 recipients since April 1, 2013.

| SFY 2013‐14 | ||||

|---|---|---|---|---|

| March 2013 | November 2013 | Increase / (Decrease) |

% Change | |

| Managed Care | 3,936,431 | 4,056,220 | 119,789 | 3.0% |

| New York City | 2,574,775 | 2,611,167 | 36,392 | 1.4% |

| Rest of State | 1,361,656 | 1,445,053 | 83,397 | 6.1% |

| Fee‐For‐Service | 1,314,647 | 1,296,926 | (17,721) | ‐1.3% |

| New York City | 626,980 | 630,902 | 3,922 | 0.6% |

| Rest of State | 687,667 | 666,025 | (21,642) | ‐3.1% |

| TOTAL | 5,251,078 | 5,353,146 | 102,068 | 1.9% |

| New York City | 3,201,755 | 3,242,069 | 40,314 | 1.3% |

| Rest of State | 2,049,323 | 2,111,078 | 61,755 | 3.0% |

• Global Cap spending is projected to be under target by $75 million in 2013-14 and $225 million in

2014‐15 ‐‐ the MRT is working.

| (dollars in millions) | 2013‐14 | 2014‐15 | TOTAL |

|---|---|---|---|

| Lower Utilization/Costs in various COS | (125) | (165) | (290) |

| Lower Medicaid Administration/State Operations costs | (50) | (60) | (110) |

| Reestimate of ACA Savings | 100 | 0 | 100 |

| TOTAL | 75 | 225 | 300 |

2014-15 Global Cap Projections

2014-15 Global Cap Projections

| Medicaid All Funds Spending ($ Millions) |

||||

|---|---|---|---|---|

| 2013‐14 | 2014‐15 | 2015‐16 | 2016‐17 | |

| State Funds | $21,383 | $21,996 | $23,042 | $23,592 |

| DOH State Funds | $16,421 | $16,962 | $17,741 | $18,329 |

| OSA State Funds | $4,962 | $5,034 | $5,301 | $5,263 |

| Federal Funds | $25,445 | $27,653 | $30,546 | $32,428 |

| Local Funds | $8,780 | $8,544 | $8,419 | $8,334 |

| All Funds | $55,608 | $58,193 | $62,007 | $64,354 |

• The Global Spending Cap is projected to grow $540 million in 2014-15; highlights include:

| Price (+$365 million) |

|

| Utilization (+$700 million) |

|

| MRT/One-Timers/Other (-$525 million) |

|

MRT Phase IV Recommendations

MRT Phase IV Recommendations

Fiscally Neutral Package of Savings and Investments

| Dollars in Millions ‐‐ Investments (Savings) | 2014‐15 Gross |

2014‐15 State |

2015‐16 Gross |

2015‐16 State |

|---|---|---|---|---|

| Start‐up Investment for BHOs/HARPs | 120 | 60 | 120 | 60 |

| Supportive Housing | 18 | 18 | 85 | 85 |

| Increased VAP Funding | 40 | 20 | 304 | 152 |

| Nursing Home Case Mix Cap | (43) | (22) | (32) | (16) |

| Pharmacy Initiatives | (33) | (16) | (62) | (31) |

| Additional Federal/Other Revenues | (91) | (66) | (93) | (57) |

| Basic Health Program | 0 | 0 | (300) | (300) |

| All Other Investments (Savings) | 52 | 6 | 88 | 32 |

| Medicaid Re‐estimate | (600) | (300) | (450) | (225) |

| Financial Plan Relief | 300 | 300 | 300 | 300 |

| Net Medicaid Proposals | (237) | 0 | (40) | 0 |

Start-up Investment for BHOs/HARPs

- Dedicates $120 million to successfully transform the Behavioral Health System as the State transitions to Managed Care:

- Targeted VAP program to preserve critical access to behavioral health inpatient and other services ($40M);

- Funding new 1915(i) - like services ($30M).

- Facilitating the transition of Behavioral Health services for adults and kids into Managed Care ($20M);

- Integration of Behavioral and Physical Health ($15M);

- Health Homes Plus for Assisted Outpatient Treatment (AOT) ($10M); and

- OASAS Residential Restructuring ($5M);

Supportive Housing

- Dedicates $100 million in SFY 2014-15 to expand access to supportive housing services:

- Continue $75 million in MRT dollars to fund various supportive housing initiatives;

- Allocate $18 million in new supportive housing dollars; and

- Designate $7 million to fund new supportive housing initiatives associated with Medicaid savings derived from the closure of hospital and nursing home beds.

VAP/Safety Net Program

- 2013‐14 Enacted Budget allocated $152 million for VAP/Safety Net Programs and $30 million for Financially Disadvantage Nursing Homes.

- 2014‐15 Executive Budget includes $194 million for VAP of which $30 million continues to be set aside for Financially Disadvantage Nursing Homes.

- 2015‐16 funding was expanded to include provider payments linked to performance.

- Over 180 applications, with a total estimated request of $1.2 billion (excluding capital), have been received to date.

| (dollars in millions) | 2013‐14 | 2014‐15 | 2015‐16 |

|---|---|---|---|

| VAP I (announced 9/12) | 55.6 | 17.8 | 0.8 |

| VAP II (announced 12/13) | 45.5 | 63.2 | 40.9 |

| VAP II (announced 1/14) | 55.8 | 17.8 | 1.6 |

| Total Awarded | 156.9 | 98.8 | 43.3 |

| Total Funding Enacted/Recommended | 182.0 | 194.0 | 458.0 |

| Total Funding Available | 25.1 | 95.2 | 414.7 |

NH Cap and Pharmacy Initiatives

- Nursing Home Case Mix Cap ($43 million):

- Addresses program integrity issues related to potential up-coding of rehabilitation services by limiting the case mix to a maximum of 2% every six months.

- Pharmacy Initiatives ($33 million):

- Prior Authorization for Non-Medically Acceptable Indicators for prescription drugs ($20 million);

- Reduce Inappropriate Prescribing and Align Point of Sale editing ($7 million);

- Require Minimum Supplemental Rebates for Brand Drugs ($3 million); and

- Eliminate e-Prescribing Incentive Payment ($3 million).

Additional Federal/Other Revenues

- Additional Federal/Other Revenues ($91 million):

- OMIG Fraud and Abuse Integrity Initiative ($30 million);

- Community First Choice Option ($28 million);

- Spousal Support ($20 million); and

- CHIPRA Performance Bonus Award ($13 million);

Basic Health Plan

- Basic Health Plan ($300 million in 2015-16):

- BHP is an option for states under the ACA; it is funded by 95% of the value of the tax credits available to individuals who would have otherwise enrolled in the Marketplace.

- BHP would be available to individuals under age 65 with income between 138-200% of FPL who are not eligible for Medicaid or CHIP and individuals with incomes below 138% of FPL who are ineligible for Medicaid due to immigration status.

- Enrollment in BHP would begin April 2015; requires CMS approval.

All Other Investments (Savings)

| Dollars in Millions ‐‐ Investments (Savings) | 2014‐15 Gross |

|---|---|

| All Payer Database/SHIN‐NY | 30 |

| Conditions of Participation (CoP) Investment | 17 |

| Regional Health Planning | 7 |

| Various MRT Investments MRT | 7 |

| Waiver Implementation | 6 |

| Health Home Criminal Justice Initiative | 5 |

| Transition of Foster Care to Managed Care | 5 |

| Reduce/Eliminate A/R Balances (within 2 to 3 years) | (16) |

| Basic Benefit Initiatives | (5) |

| Program Integrity Initiatives | (4) |

| Net All Other Investments (Savings) | 52 |

Other Programs/Proposals in the Global Cap

A/R Balance - January 2014

- A/R balances are projected to be reduced to $100 million on March 31, 2015.

- The A/R reduction proposal:

- Negotiates equitable repayment arrangements with providers owing significant liabilities.

- Revises collection enforcement policies for providers below the standard recoupment percentage.

2% ATB Restoration

- $120 million of the 2% ATB cut was partially restored in 2013-14:

- MMC/FHP ($87 million).

- Various FFS categories ($33 million).

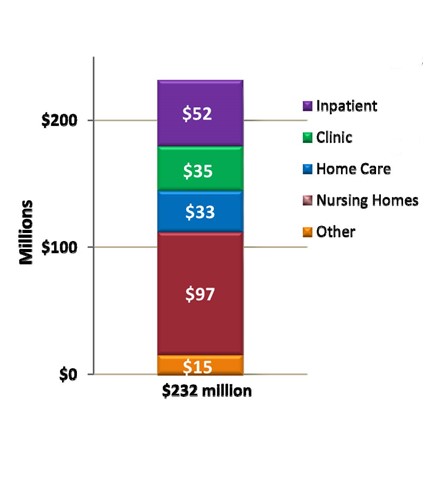

- The balance ($237 million) of the 2% ATB will be restored effective April 1, 2014.

| Category of Service | 2013‐14 Target |

2014‐15 Restoration |

|---|---|---|

| Inpatient | $58.5 | $43.3 |

| Outpatient/Emergency Room | $6.3 | $6.3 |

| Clinic | $3.3 | $3.3 |

| Nursing Homes | $72.9 | $67.6 |

| Other Long Term Care | $46.7 | $24.4 |

| Managed Care | $78.2 | $0.0 |

| Long Term Managed Care | $13.1 | $12.6 |

| Family Health Plus | $10.8 | $0.0 |

| Non‐Institutional | $67.3 | $79.0 |

| Totals | $357.1 | $236.5 |

Wage Parity

- Effective March 1, 2014, Home Care Worker Wage Parity requires compensation be:

- "no less than the prevailing rate of total compensation as of 1/1/11 or the total compensation mandated by the living wage law, whichever is greater."

- DOH and DOL collaborated on developing the worker prevailing wage for managed long term care and fee-for-service providers ($20.95):

- Rate accommodates wage parity for NYC ($14.09) and Westchester, Nassau and Suffolk counties ($10.93) plus additional costs such as taxes, worker´s compensation, overtime as well as 30% in administration costs.

- The Global Cap set aside $350 million (gross) to accommodate this expense.

- VAP funding ($20 million) is available to assist Licensed Home Care Service Agencies with consolidation and transition costs.

Article VII Highlights

Article VII Highlights

- Extends Global Cap through March 2016.

- Repeals 2% Across the Board payment reduction effective April 1, 2014.

- Provides flexibility in restoring alternate savings measures.

- Creates a Global Cap Dividend payment.

MRT: Additional Information

- MRT Website: http://www.health.ny.gov/health_care/medicaid/redesign/

- Sign up for email updates: http://www.health.ny.gov/health_care/medicaid/redesign/listserv.htm

- ´Like´ the MRT on Facebook: http://www.facebook.com/NewYorkMRT

- Follow the MRT on Twitter: @NewYorkMRT

Follow Us