FY 2016 Executive Budget and Global Cap Update

February 2015

- Update is also available in Portable Document Format (PDF, 1MB)

Agenda

- Global Cap Recap

- Results through November 2014

- Closeout Strategy

- FY 2016 Global Cap Projections

- MRT Phase V Recommendations

- Article VII Highlights

- Questions

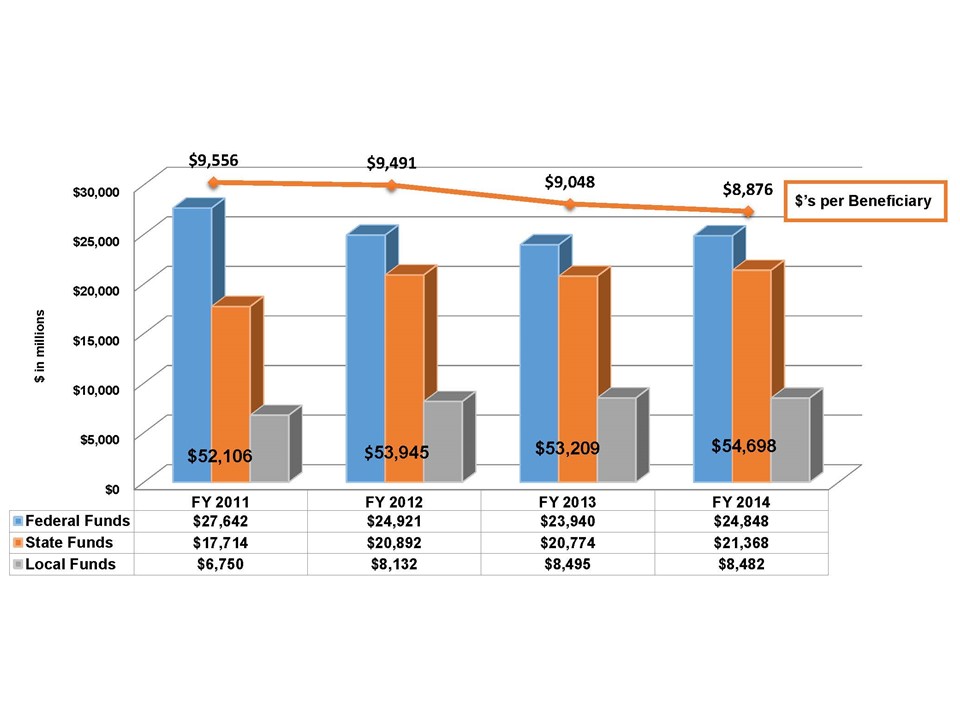

Medicaid All Funds Spending (FY2011-14)

"Bending" the Cost Curve

Global Cap Recap

- The Global Cap for FY 2015 is $17.0 billion.

- Reflects annual growth of $540 million (primarily for price and utilization).

- Enrollment is projected to reach 6.1 million by March 2015, an increase of 400,000 enrollees from March 2014.

- Includes 140,000 expansion recipients (100 percent federally funded)

Results through November 2014

- Through November spending under the Global Cap was $10 million below estimates;

- Fee-For-Service and Medicaid Managed Care spending are on target with estimates;

- Timing related issues include lower spending in Other State Agencies (-$58 million) offset by lower audit recoveries (+$52 million).

- Health care coverage was provided to an additional 287,000 fragile and low income recipients through November:

- Medicaid Managed Care enrollment increased by 403,000 recipients.

- Fee for Service enrollment decreased by 116,000 recipients.

• Medicaid expenditures through November 2014 are $10 million or 0.09% below projections.

Medicaid Spending November 2014

(dollars in millions) |

| Category of Service |

Estimated |

Actual |

Variance |

| Medicaid Managed Care |

$8,058 |

$8,061 |

$3 |

| Mainstream Managed Care |

$5,820 |

$5,842 |

$22 |

| Long Term Managed Care |

$2,238 |

$2,219 |

($19) |

| Family Health Plus |

$289 |

$314 |

$25 |

| Total Fee For Service |

$6,312 |

$6,304 |

($8) |

| Inpatient |

$1,973 |

$1,977 |

$4 |

| Outpatient/Emergency Room |

$265 |

$271 |

$6 |

| Clinic |

$379 |

$368 |

($11) |

| Nursing Homes |

$2,208 |

$2,223 |

$15 |

| Other Long Term Care |

$477 |

$473 |

($4) |

| Non-Institutional |

$1,010 |

$992 |

($18) |

| Medicaid Administration Costs |

$292 |

$318 |

$26 |

| OHIP Budget / State Operations |

$111 |

$100 |

($11) |

| Medicaid Audits |

($270) |

($218) |

$52 |

| All Other |

$1,620 |

$1,523 |

($97) |

| Local Funding Offset |

($4,966) |

($4,966) |

$0 |

| TOTAL |

$11,446 |

$11,436 |

($10) |

• Medicaid enrollment through November 2014 increased by 287,397 recipients since April 1, 2014.

Medicaid Enrollment Summary

FY 2015) |

| |

March 2014 |

November 2014 |

Increase / (Decrease) |

| Managed Care |

4,126,307 |

4,529,526 |

403,219 |

| New York City |

2,589,618 |

2,809,361 |

219,743 |

| Rest of State |

1,536,689 |

1,720,165 |

183,476 |

| Fee-For-Service |

1,578,130 |

1,462,308 |

(115,822) |

| New York City |

790,996 |

713,374 |

(77,622) |

| Rest of State |

787,134 |

748,934 |

(38,200) |

| TOTAL |

5,704,437 |

5,991,834 |

287,397 |

| New York City |

3,380,614 |

3,522,735 |

142,121 |

| Rest of State |

2,323,823 |

2,469,099 |

145,276 |

Results through November 2014

- DOH is engaged in an initiative to reduce all

outstanding A/R liabilities by March 31, 2017.

- Providers with outstanding liabilities will

be required to submit proposals that achieve full

recovery of the liabilities over the next two years.

Closeout Strategy

- DOH monitors the Global Cap spending closely and expects to end the year on target

- Major rate packages to be processed before the fiscal year ends

- April 2014 Mainstream Managed Care Rates ($420 million)

- Other scheduled rate packages are at risk due to CMS delay and will roll into FY 2016:

- Federal credits in the Global Cap are also at risk due to CMS delay:

- SSHS Cost Study

- Additional Federal Revenue from Emergency Services (Aliessa population)

- If necessary to balance rolled liabilities, the Department may consider advancing FY 2016 payments into FY 2015 (i.e., DSH)

FY 2016 Global Cap Projections

- The Global Spending Cap will increase to $17.7 billion in FY 2016, reflects growth of $779 million; highlights include:

| Price (+$403 million) |

- 4% trend increases for mainstream managed care and long term managed care ($353 million);

- Various FFS rate packages ($50 million).

|

| Utilization (+$480 million) |

- Annualization of FY 2015 net enrollment;

- New enrollment for FY 2016, including the ACA "woodwork".

|

| MRT/One-Timers/Other (-$104 million) |

- Basic Health Program (-$945 million);

- ACA FMAP (-$294 million); offset by

- MH Stabilization funds ($200 million, incl. Financial Plan relief);

- VAP Funding ($290 million);

- Medicaid 53 rd cycle ($207 million);

- Loss in one-time Federal Revenue ($200 million);

- Additional Funding to support the Waiver ($100 million);

- Hospital Quality and Essential/Rural Community Provider Investment ($100 million); and

- Executive Order on Immigration ($38 million).

|

MRT Phase V Recommendations

Fiscally Neutral Package of Savings and Investments

| Dollars in Millions (State Share) -- Investments (Savings) |

2015-16 |

2016-17 |

| Basic Health Program Acceleration (Incremental to FY 2015 Budget) |

(645) |

(219) |

| ACA FMAP Increase for Childless Adults |

(294) |

(275) |

| Pharmacy Initiatives |

(89) |

(116) |

| VAP (Including Single Public PPSs) |

290 |

240 |

| Medicaid 53rd Cycle |

207 |

0 |

| Financial Plan Relief |

200 |

200 |

| Hospital Quality and Essential/Rural Community Provider Investment |

100 |

100 |

| Additional Funding to Support the Waiver |

100 |

100 |

| Alzheimer´s Caregiver Support |

25 |

25 |

| Health Home Care Management for Children |

23 |

45 |

| All Other Investments (Savings) |

83 |

(100) |

| Net Medicaid Proposals |

0 |

0 |

Basic Health Program

- The Basic Health Plan will be implemented in 2 phases

- Phase I - Effective 4/1/15, Aliessa enrollees will "transition in place" into the BHP and will remain in their respective plans.

- Phase II - Effective 10/1/15, eligible enrollees from the Marketplace will transition into the BHP for coverage effective January 2016.

| ($´s in millions) |

Total BHP Cost |

Federal Subsidies |

GC (Benefit) / Cost |

GC Benefit for Aliessa |

Annual State Savings |

| Phase I |

989 |

(1,005) |

(16) |

(839) |

(855) |

| Phase II |

654 |

(504) |

150 |

(280) |

(130) |

| Total |

1,643 |

(1,509) |

134 |

(1,119) |

(985) |

| Already Budgeted Savings* |

300 |

| BHP Administration Costs |

35 |

| Inclusion of the Aliessa Wrap |

8 |

| Elimination of the FHP Wrap |

(3) |

| Net BHP Savings |

(645) |

*$300 million in savings was included in FY 2015 Enacted Budget.

ACA FMAP Increase for Childless Adults

- ACA FMAP ($294 million in 2015-16):

- Under the Affordable Care Act the State is able to claim an enhanced Federal Medical Assistance Percentage associated with childless adults.

- On January 1, 2015, the FMAP increases from 75 percent to 80 percent.

| ($´s in millions) |

FY 2014 |

FY 2015 |

Growth |

| Enhanced FMAP |

(1,564) |

(1,945) |

(381) |

| Local Share of FMAP |

435 |

522 |

87 |

| Total |

(1,129) |

(1,423) |

(294) |

Pharmacy Initiatives

- Pharmacy Initiatives ($89 million in 2015-16):

- Leverage Pharmacy Rebates ($41 million);

- AWP Discount for Brand Name Drugs and Dispensing Fee Adjustment ($18 million);

- Implement Managed Care Pharmacy Efficiencies ($13 million);

- 340B Pricing in Managed Care ($11 million); and

- Reduce Inappropriate Prescribing / Specialty Pharmacy Vendor ($6 million).

Hospital Quality and Essential / Rural Community Provider Investment

- Hospital Quality and Essential/Rural Community Provider Investment ($100 million):

- This proposal reinvests 3 percent to the Hospital industry through various investments and restorations:

- Establishes a quality pool;

- Eliminates the potentially preventable negative outcomes (PPNOs) rate adjustment;

- Eliminates across-the-board (ATB) rate reduction for unnecessary elective deliveries;

- Reduces HCRA Obstetrics Assessment by $15 million; and

- Provides targeted investments to essential community healthcare providers.

Vital Access Provider Program

| ($´s in millions) |

FY 2016 |

FY 2017 |

| Gross |

State |

Gross |

State |

| Current VAP Funding |

$372 |

$186 |

$372 |

$186 |

| Transitional Operational Support |

$500 |

$250 |

$400 |

$200 |

| Funding for Single Public PPSs |

$80 |

$40 |

$80 |

$40 |

| Total |

$952 |

$476 |

$852 |

$426 |

Article VII Highlights

- Extends Global Cap

- Extends Indigent Care

- Value Based Payments

Questions

Follow Us